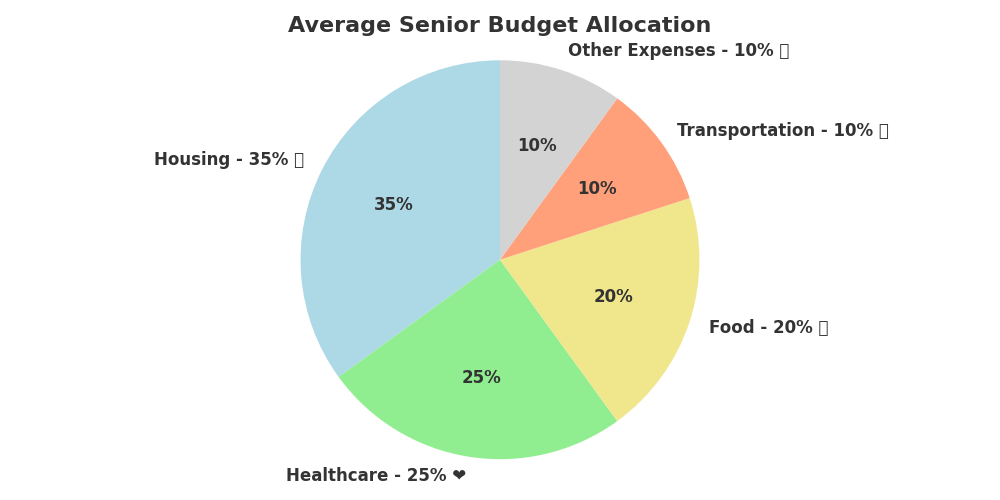

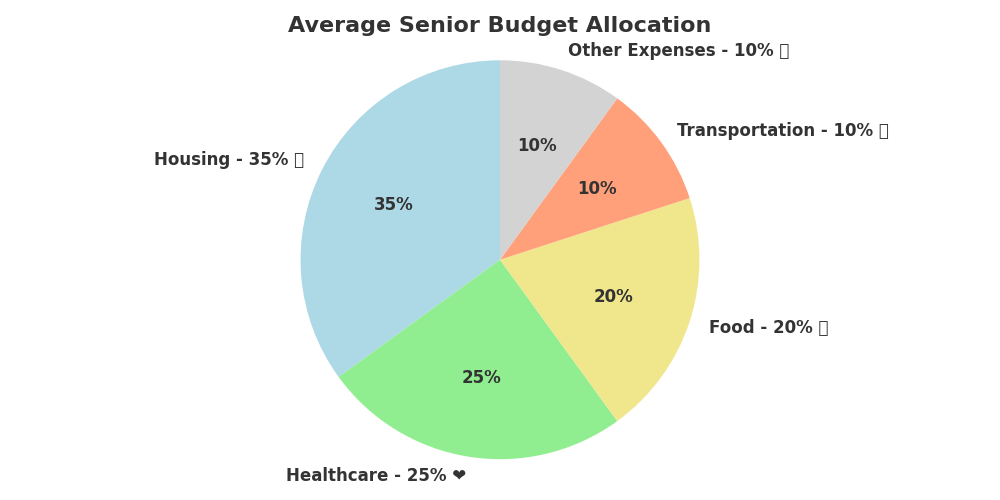

💡 Did You Know?

According to recent studies, 70% of seniors prefer to age in place , but many struggle with the high costs of maintaining their current homes. This makes finding affordable alternatives a top priority.

Actionable Tip:

Consider downsizing to a smaller home or exploring senior-specific housing communities. These options can significantly reduce expenses while providing access to supportive services.

2. Types of Affordable Housing for Seniors

There are several types of affordable housing options available for seniors, each designed to meet different needs and budgets. Here are some of the most common choices:

- 🛋️ Senior Apartments:

These are rental units specifically designed for seniors aged 55+. They often include amenities like community centers, transportation services, and maintenance-free living. - ❤️🏠 Assisted Living Facilities:

For seniors who need additional support with daily activities, assisted living facilities offer a combination of housing, personal care, and healthcare services. - 🏘️ Subsidized Housing Programs:

Government-backed programs, such as Section 8 Housing or Low-Income Housing Tax Credits (LIHTC) , provide affordable rental options for low-income seniors. - 🚐 Mobile Home Parks:

Living in a mobile home park can be an economical choice, with lower utility and maintenance costs compared to traditional homes.

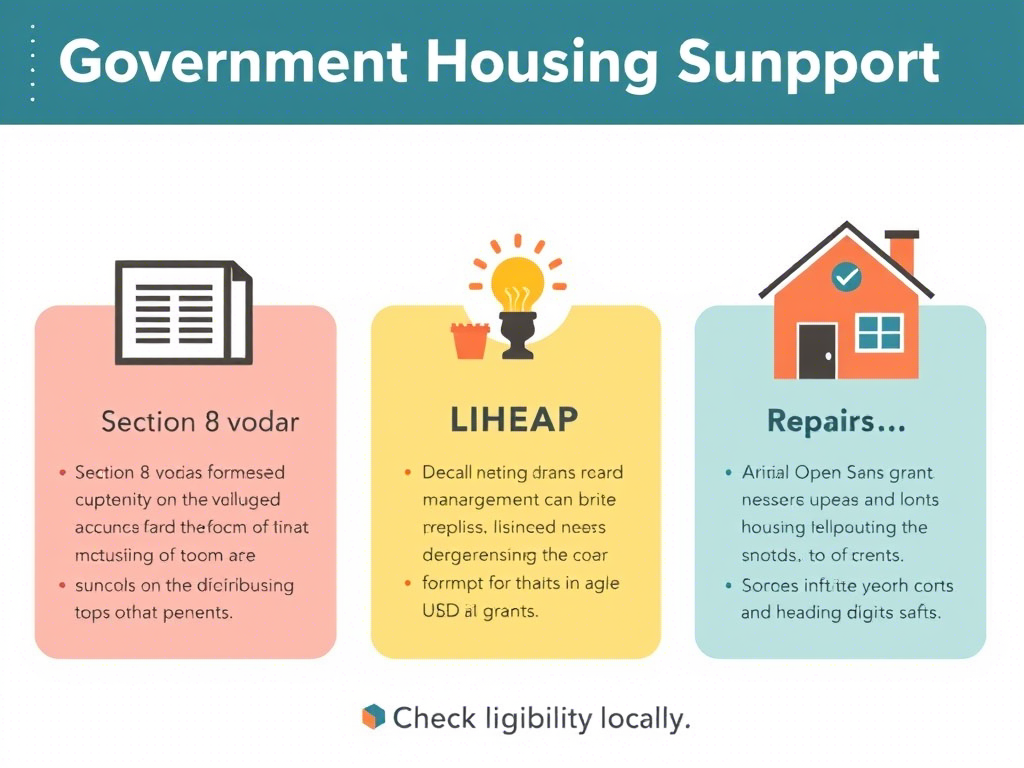

3. Government Programs and Subsidies

Many seniors are unaware of the government programs available to assist with housing costs. These programs can provide significant financial relief, making affordable housing more accessible.

Here are some key programs to consider:

- Section 8 Housing Choice Voucher Program:

This program helps low-income seniors pay for rental housing in the private market. Eligible participants receive vouchers to cover part of their rent. - Low-Income Home Energy Assistance Program (LIHEAP):

LIHEAP provides assistance with heating and cooling costs, helping seniors reduce utility expenses. - USDA Rural Repair and Rehabilitation Grants:

Seniors living in rural areas may qualify for grants to repair or improve their homes, ensuring they remain safe and livable.

senior housing subsidy programs table

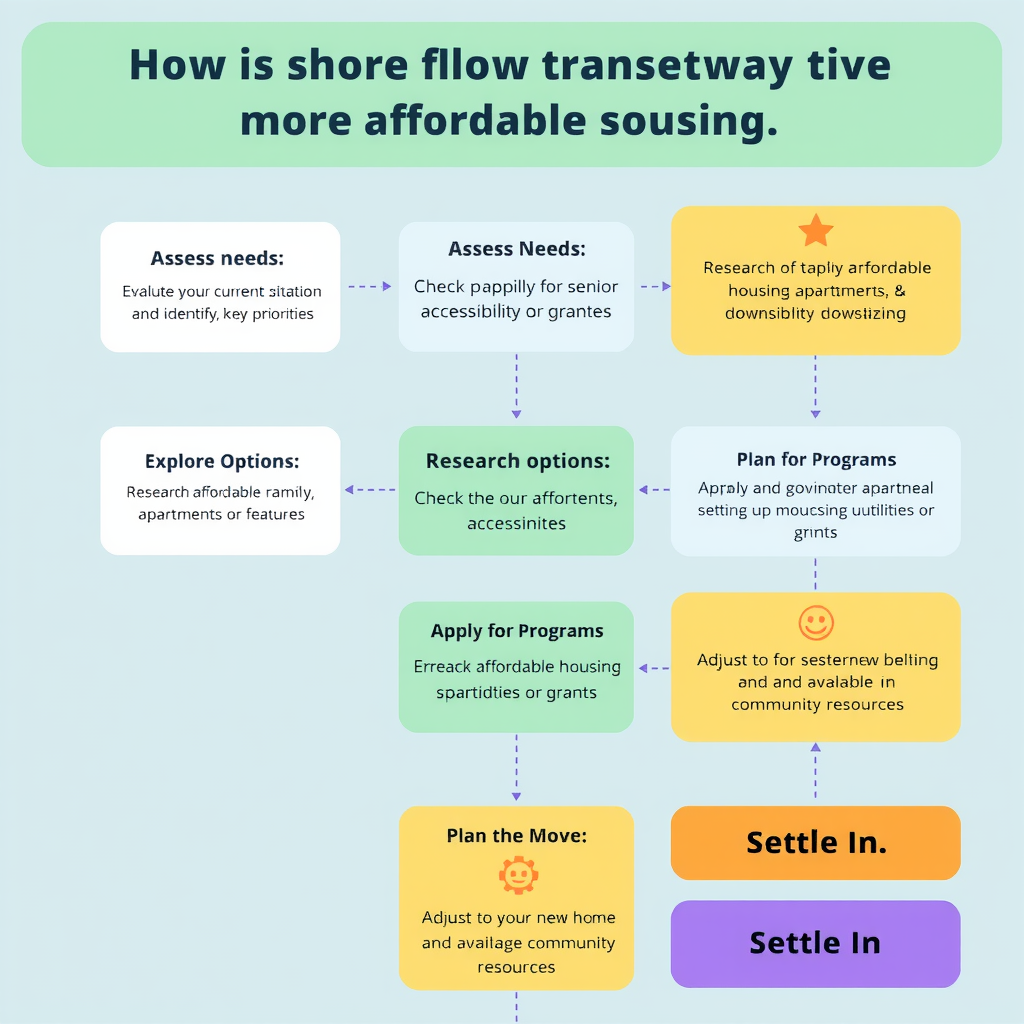

4. Downsizing as a Cost-Saving Strategy

Downsizing is one of the most effective ways for seniors to reduce housing costs. Moving to a smaller home or apartment can lower mortgage payments, utility bills, and maintenance expenses. Additionally, downsizing often frees up equity, which can be reinvested into savings or used to fund other retirement goals.

📉 Actionable Tip:

Before downsizing, create a checklist of your must-haves (e.g., proximity to family, accessibility features) to ensure your new home meets your needs.

💡 Pro Tip:

If selling your current home isn’t ideal, consider renting it out to generate passive income while you move to a more affordable option.

5. Additional Tips for Affordable Living

Beyond housing, there are other ways to stretch your budget and live comfortably after 50. Here are a few additional strategies:

- Share Housing Costs:

Consider living with a roommate or family member to split expenses. This can be a great way to save money while enjoying companionship. - Explore Senior Discounts:

Many housing communities and utility providers offer discounts specifically for seniors. Don’t hesitate to ask about these opportunities. - Relocate to a More Affordable Area:

If possible, consider moving to a region with a lower cost of living. Smaller towns or rural areas often have more affordable housing options.

Finding affordable housing for seniors doesn’t have to be overwhelming. By exploring different options, leveraging government programs, and considering downsizing, you can create a comfortable and budget-friendly living arrangement during your golden years. Remember, planning ahead and seeking professional advice can make all the difference in ensuring a secure and stress-free retirement.

🌟 For more tips on managing finances after 50, don’t miss our article on How to Start a Side Hustle After 50: Turn Your Passion into Profit