The rivalry between the two retail giants now extends well beyond traditional shopping. Both companies offer membership programs that combine shipping perks, streaming video and pharmacy benefits. Walmart+, launched in 2020, directly challenges Amazon Prime’s bundle of services, while Amazon continues to expand its entertainment portfolio through Prime Video and live-sports rights. In cloud computing, Amazon Web Services holds a sizable market share lead, but Walmart has been building its own technology capabilities and partnering with multiple providers to support logistics and data operations.

Artificial intelligence represents another competitive front. Amazon is integrating generative AI tools across product search, advertising and device ecosystems, leveraging the infrastructure of AWS to attract enterprise customers. Walmart is deploying machine-learning systems to optimize inventory, forecast demand and personalize the online shopping experience. Both companies are expected to accelerate investment in large-language models that can automate customer support and supply-chain planning.

The handoff atop the Fortune 500 underscores how e-commerce has altered consumer expectations around price, convenience and speed. When Amazon’s rapid-delivery model began to gain traction a decade ago, Walmart initially underestimated the shift. The Arkansas retailer’s subsequent course correction—including the $3.3 billion acquisition of Jet.com in 2016 and billions more in technology upgrades—reoriented the company toward omnichannel fulfillment. As a result, Walmart avoided the fate of former industry peers like Sears and Kmart, which struggled to adapt and eventually filed for bankruptcy.

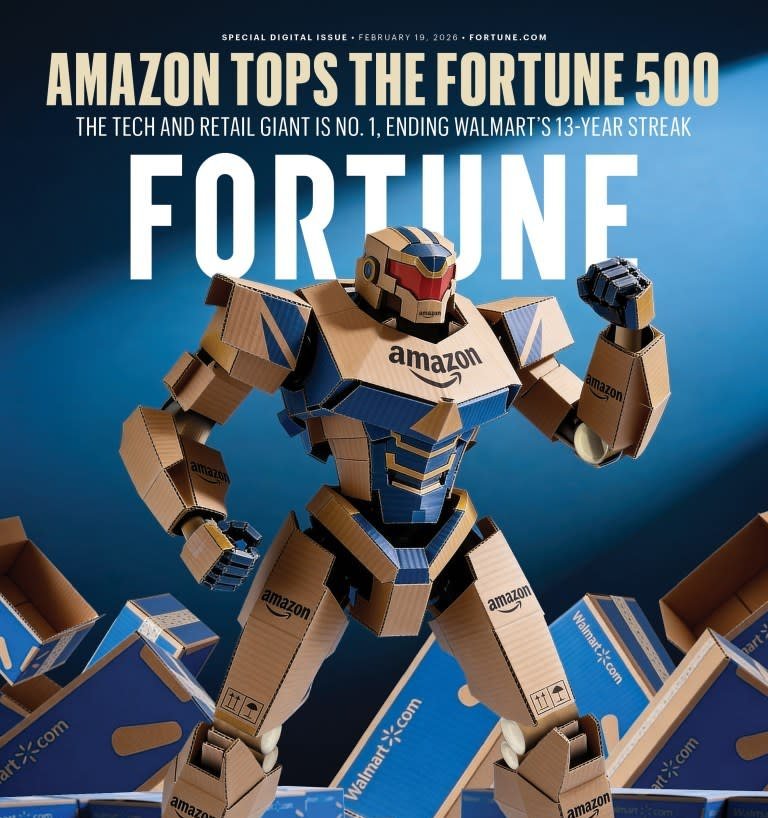

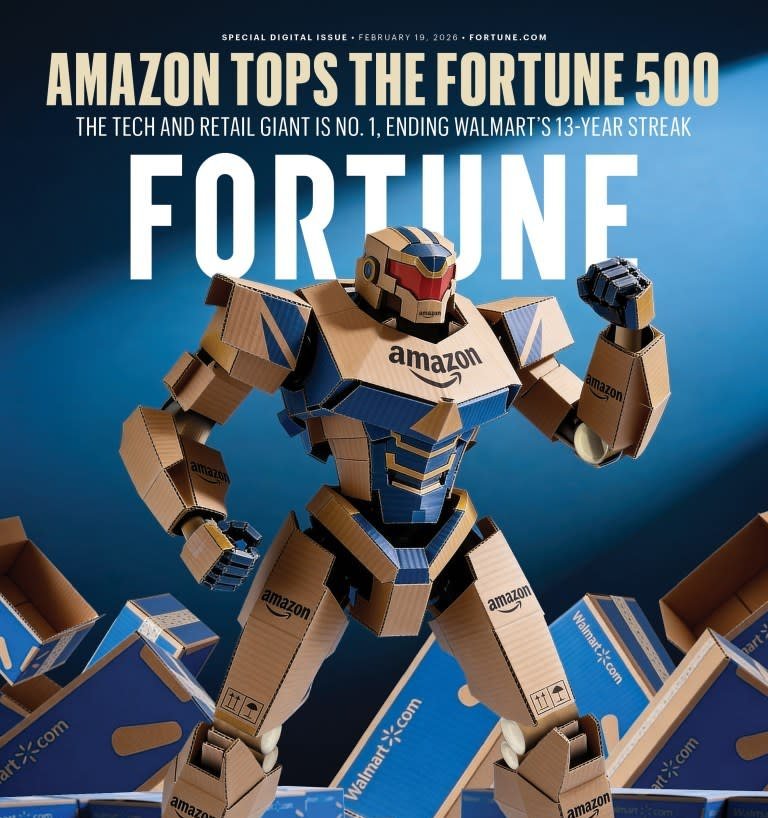

For Amazon, the milestone caps a period of recalibration after pandemic-era expansion led to overcapacity in its fulfillment network. Cost-cutting measures, warehouse optimization and a renewed focus on higher-margin businesses stabilized profitability in 2025. Advertising revenue grew at a double-digit pace, and AWS remained the principal earnings engine despite intensifying competition from Microsoft Azure and Google Cloud. Analysts expect Amazon to continue pruning smaller experiments while pursuing new categories such as healthcare and autonomous logistics.

Imagem: Internet

The broader market backdrop has been encouraging. U.S. equities finished most sessions in positive territory during the latest quarter, even as investors monitored rising tensions between Washington and Tehran. Retail stocks in particular benefited from resilient consumer spending and moderating inflation, factors that buoyed both Amazon and Walmart. Interest in the forthcoming Fortune 500 list remains high; the ranking, compiled from publicly reported revenue data, is widely regarded as a barometer of corporate influence. Additional methodology details are available on Fortune’s official site.

Looking ahead, Amazon and Walmart are expected to intensify competition across logistics, same-day delivery and subscription services. Amazon continues to test drone distribution and regionalized fulfillment nodes, while Walmart is rolling out automated micro-fulfillment centers within stores to shorten last-mile delivery times. Both firms are also exploring international growth opportunities, with Amazon focusing on India and Latin America and Walmart boosting its presence in markets such as Mexico and Canada.

Whether Amazon’s tenure at the top will be brief or prolonged will hinge on execution in these adjacent arenas. For now, the 2026 Fortune 500 will mark a historic moment: the first publication in more than a decade that does not list Walmart in the premier position. The shift illustrates the dynamic nature of U.S. commerce and the speed at which strategic pivots can redefine industry hierarchies.

Crédito da imagem: Fortune