Regional index performance

Japan’s Nikkei 225 slipped 0.92%, while the broader Topix finished little changed. South Korea’s Kospi lost 0.85% and the small-cap Kosdaq retreated 0.74%. Australia’s S&P/ASX 200 edged down 0.17%.

Futures for Hong Kong’s Hang Seng pointed to a firmer open at 25,319, compared with Friday’s close of 25,077.62, but the positive signal failed to lift sentiment across the region.

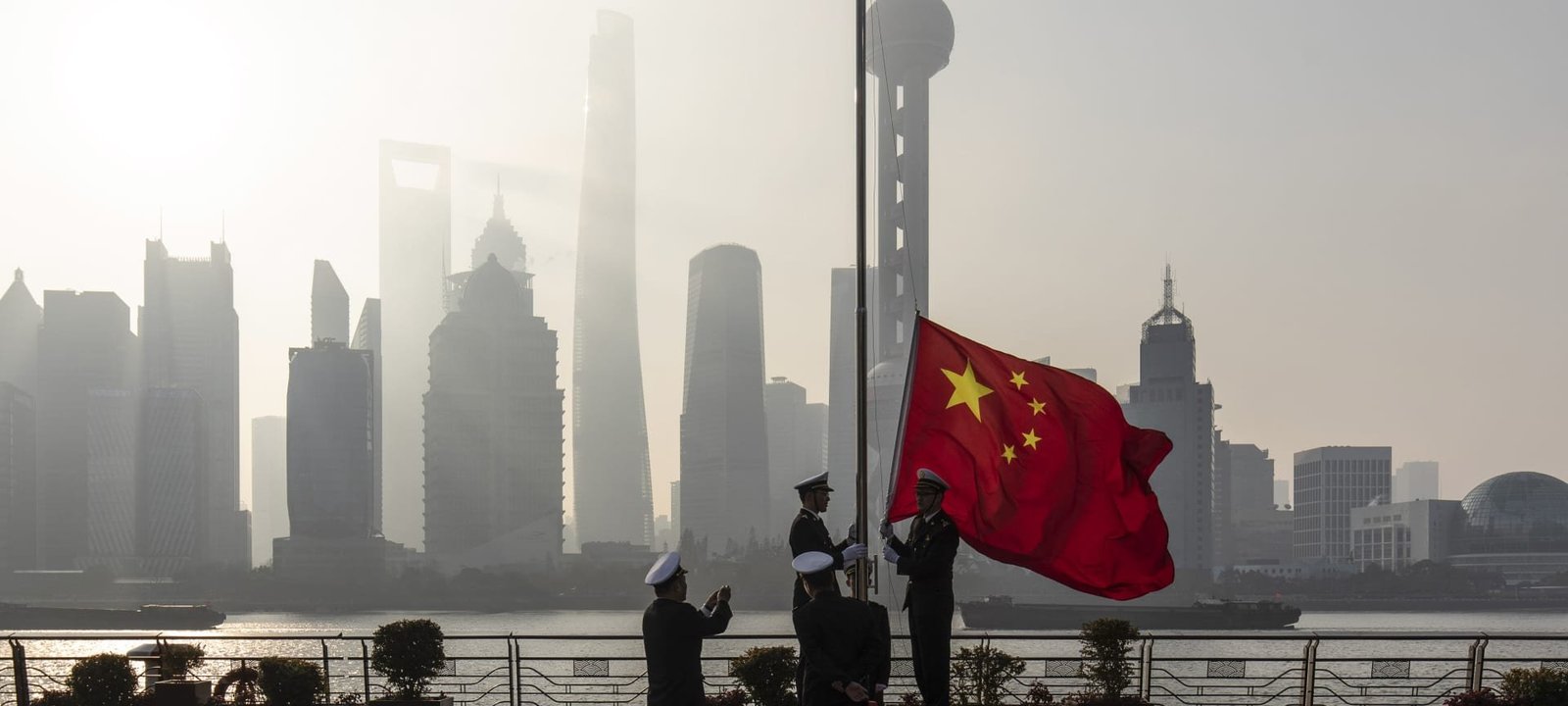

Focus on Chinese data and Alibaba shares

Market attention turned to China’s August manufacturing data from private survey provider Ratingdog. Economists polled by Reuters expect a reading of 49.7, slightly above July’s 49.5 yet still below the 50-point threshold that separates expansion from contraction. Official weekend data showed the country’s manufacturing PMI at 49.4, versus 49.3 a month earlier.

Shares of Alibaba Group remained in focus after the company’s U.S.-listed stock jumped nearly 13% on Friday on stronger-than-expected quarterly earnings. Investors awaited regional trading to gauge whether that momentum would carry over to Hong Kong.

Wall Street backdrop

U.S. stocks ended lower on Friday as fresh inflation figures underscored persistent price pressures. The S&P 500 declined 0.64% to 6,460.26, the Nasdaq Composite fell 1.15% to 21,455.55 and the Dow Jones Industrial Average slipped 0.20% to 45,544.88. Despite the pullback, the S&P 500 recorded its fourth consecutive monthly gain. U.S. markets are closed on Monday for the Labor Day holiday.

With the U.S. session halted, Asia-Pacific traders will likely continue to weigh the implications of the tariff ruling, upcoming Chinese economic releases and geopolitical signals from the SCO meeting.

For additional context on the latest market moves and personal finance implications, visit our recent finance news update.

Image credit: Qilai Shen | Bloomberg | Getty Images