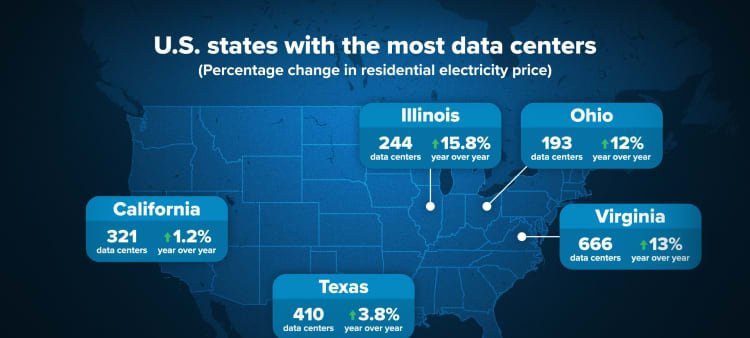

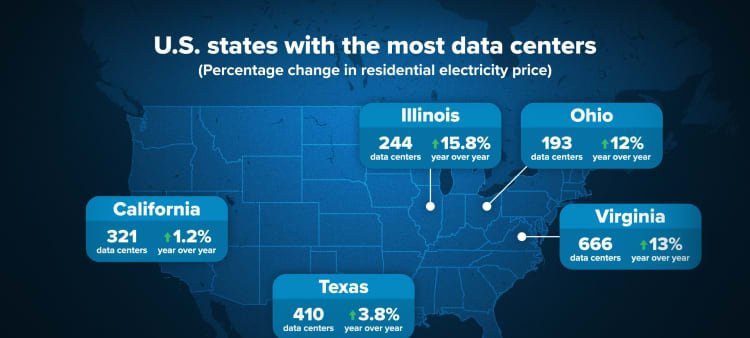

While neither Vermont nor Florida ranks among the nation’s top data center markets, surging utility bills have turned the issue into a wider political flashpoint. In Virginia, the world’s largest hub for cloud infrastructure, dissatisfaction over energy costs factored into Democrat Abigail Spanberger’s decisive gubernatorial victory this year. National electricity prices add to the pressure: the U.S. Energy Information Administration forecasts an average residential increase of roughly 5 percent in 2025 and another 4 percent in 2026.

Industry demand is particularly acute in PJM Interconnection, the country’s largest regional transmission organization, which serves about 65 million people across 13 Mid-Atlantic and Midwest states, including key election battlegrounds such as Pennsylvania and Virginia. PJM projects that by 2027 it will face a shortfall of six gigawatts—nearly the entire electricity consumption of Philadelphia—against its reliability requirement. Analysts say that deficit substantially raises the risk of blackouts.

Monitoring Analytics, the independent market monitor for PJM, has estimated that $23 billion in recent capacity costs can be traced to data center growth. Those expenses flow through to ratepayers, prompting the watchdog to describe the trend as a “massive wealth transfer” in a November letter to grid operators.

Power-sector veterans point to a shift in political attitudes. Abe Silverman, who served as general counsel to New Jersey’s Board of Public Utilities until last year, noted that elected officials once viewed data centers as unalloyed engines of economic development. A tightening supply of generation, however, has led to questions about whether new facilities should proceed without additional sources of electricity.

Complicating matters, Trump’s recent decision to halt all offshore wind projects under construction along the East Coast removed 2.6 gigawatts of planned capacity from the queue, including the Coastal Virginia Offshore Wind project that northern Virginia’s data center market had expected to tap. Silverman said the suspension widens the gap between supply and demand and is likely to push consumer rates even higher.

Imagem: Internet

Regulators and grid planners are weighing new guardrails. PJM’s market monitor has urged the grid operator to deny data center interconnection requests unless developers secure dedicated power sources or build their own generation. Beginning in 2027, Virginia regulators will require data centers to shoulder most of the cost of transmission lines and generating assets built on their behalf.

Facing longer queues and tighter capacity, some developers are preparing to construct on-site power plants in a strategy known as co-location. Brian Fitzsimons, chief executive of GridUnity, said the trend could accelerate next year as companies look for faster paths to reliable electricity. Even so, critics such as Silverman warn that private generation facilities could remove scarce megawatts from the broader market, heightening blackout risks for households and businesses not tied to a data center.

Political strategists expect the debate over data centers to reverberate through the 2026 mid-term elections, when control of Congress and more than three dozen governorships will be at stake. Rob Gramlich, president of consulting firm Grid Strategies, predicted that candidates from both parties will frame energy affordability as a central campaign theme, positioning themselves either as protectors of the grid or champions of technological innovation.

Whether bipartisan skepticism coalesces into concrete federal or state limits remains unclear. Sanders has indicated that his current Senate term, ending in 2024, is likely his last, while DeSantis is completing his second and final term in Tallahassee with future ambitions yet undeclared. Nonetheless, their shared concerns underscore a turning point: data centers, once viewed primarily as economic assets, are now at the center of a national conversation about energy security and consumer costs.

Crédito da imagem: original source