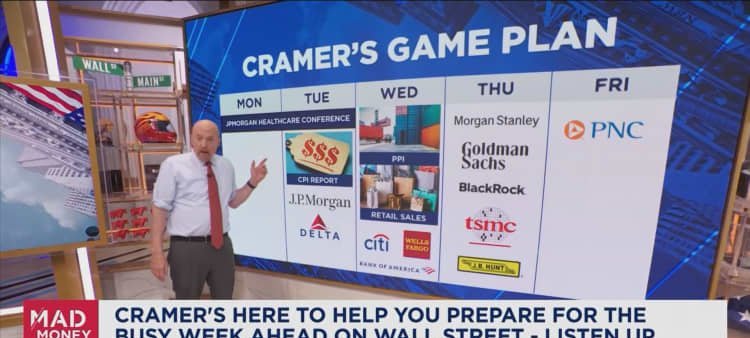

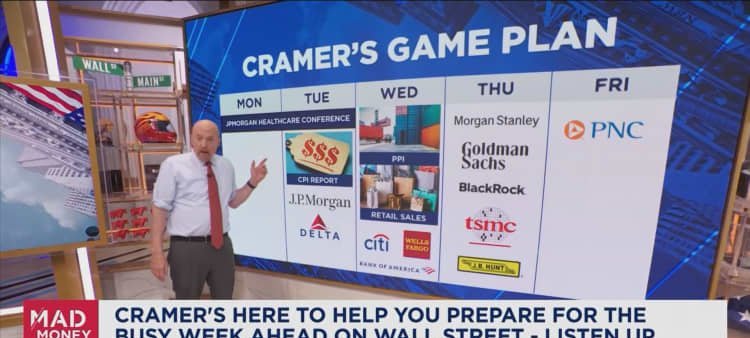

The economic calendar also includes Tuesday’s release of December’s Consumer Price Index, a data point Cramer believes will carry greater market weight than the latest jobs figures. Holiday spending patterns suggest price pressures may remain elevated, potentially complicating efforts by policymakers to cool inflation. For context, the Bureau of Labor Statistics maintains historical CPI data on its official website.

Earnings season formally opens the same day with results from JPMorgan Chase. Cramer anticipates a strong quarter from the banking giant but cautioned that Chief Executive Jamie Dimon often emphasizes risk factors on conference calls, a habit that has occasionally pushed the stock lower in the short term. His strategy is to monitor Dimon’s commentary and consider buying shares if a temporary decline emerges.

Other major banks will follow in rapid succession. Citigroup, PNC Financial, Wells Fargo, Bank of America, Goldman Sachs and Morgan Stanley all appear well positioned, according to Cramer, who singled out Citigroup as a potential outperformer. He added that PNC’s report, expected Friday, should help establish the broader tone for financial earnings.

In the travel sector, Delta Air Lines is slated to release quarterly results later in the week. Cramer forecasted solid numbers from the carrier and suggested that a positive report could reinforce optimism about the post-pandemic recovery in commercial aviation. Within transportation, he is also tracking J.B. Hunt Transport Services; a strong performance there would, in his view, validate recent confidence in FedEx shares.

Imagem: Internet

Asset-management heavyweight BlackRock will present its latest figures during the opening stretch of the season. While Cramer expressed confidence in the firm’s outlook, he warned that lofty expectations may already be reflected in the stock price.

On the semiconductor front, Taiwan Semiconductor Manufacturing Company will issue quarterly earnings and an updated capacity outlook. Cramer believes that report could influence sentiment toward Nvidia by clarifying demand trends for high-performance chips. Until then, he expects capital to keep flowing into storage-oriented equipment suppliers and memory producers.

Throughout the discussion, Cramer emphasized that investors should avoid trying to trade Apple and Nvidia based on short-term price movements. Both enterprises remain operationally healthy, he said, but are currently acting as sources of funds for market participants rotating into sectors viewed as undervalued or under-owned.

By the end of the upcoming week, with several blue-chip banks, an airline, major transport operators and leading technology firms having reported, Cramer expects investors to have a clearer assessment of corporate earnings strength heading into the first quarter. Until then, he regards the ongoing movement of money into overlooked corners of the market as the primary dynamic shaping U.S. equities.

Crédito da imagem: CNBC