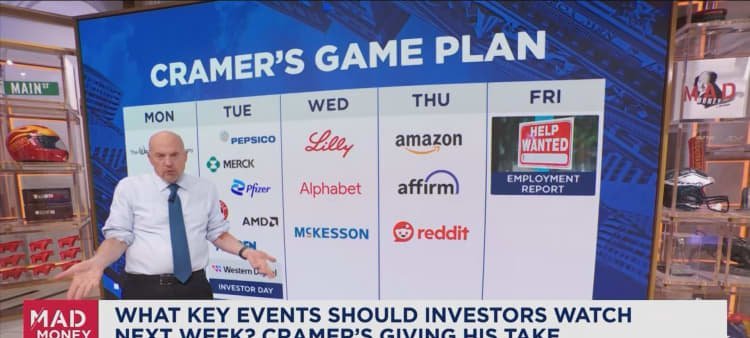

Also on Tuesday, Western Digital holds an “innovation day” designed to showcase new storage technologies aimed at rising cloud and enterprise demand. The presentation follows a sharp share-price decline on Friday that occurred despite stronger-than-forecast quarterly earnings, making the event a critical opportunity for the company to rebuild confidence.

Wednesday Morning: Eli Lilly’s GLP-1 Focus

Pharmaceutical giant Eli Lilly issues results before Wednesday’s opening bell. While analysts will parse revenue and earnings, the primary interest centers on any updates to the firm’s GLP-1 obesity and diabetes drug portfolio. Investors are watching for fresh clinical-trial data that could affect long-term growth prospects. Lilly shares are down roughly 3.5 percent since the start of the year, and additional information on the drug pipeline could prove more influential than headline quarterly metrics.

Wednesday Night: Alphabet’s Turn in the Spotlight

Alphabet, parent company of Google, reports after the close on Wednesday. Market participants view the release as one of the most consequential of the season because the firm straddles search advertising, cloud computing and emerging artificial-intelligence tools such as the Gemini chatbot. Alphabet’s standing within the so-called “Magnificent Seven” technology cohort improved over the past several months, and investors will evaluate whether YouTube engagement, Waymo’s autonomous-vehicle progress and core search trends justify the recent shift in sentiment.

Thursday: Amazon Faces Skeptical Trade

Amazon.com publishes results Thursday afternoon. The e-commerce and cloud-services leader has experienced choppy price action, with gains often capped by selling pressure once momentum appears. Cramer characterized the stock as controversial despite acknowledging the company’s operational strength. Thursday’s numbers will offer insight into consumer demand, advertising growth and Amazon Web Services performance, each a key driver of profitability.

Imagem: Internet

Friday: Jobs Report Caps the Week

The January employment report arrives Friday morning. A weaker-than-expected reading on job creation or wage growth could ease concerns about persistent inflation and, in turn, support lower Treasury yields. According to the U.S. Bureau of Labor Statistics, the release will detail nonfarm payroll additions, the unemployment rate and average hourly earnings, all critical for assessing the Federal Reserve’s next policy steps. A softer labor print could provide equities with an additional tailwind to close out the week.

Market Context and Portfolio Exposure

The S&P 500 finished lower in each of the last three sessions, setting a cautious tone ahead of the earnings deluge. Cramer argued that strong showings from the week’s marquee reporters, combined with a benign jobs report, could catalyze a rebound. His charitable trust currently holds positions in Eli Lilly, Amazon and Alphabet, aligning portfolio exposure with several of the most closely watched names on the calendar.

Beyond individual companies, investors will monitor bond-market moves and broader macroeconomic indicators. Lower yields often bolster valuations for high-growth and technology stocks, intensifying the focus on Friday’s labor data. Additionally, corporate commentary on consumer demand, supply-chain conditions and capital-expenditure plans will help clarify whether the economy is cooling or merely normalizing after the post-pandemic expansion.

In summary, Wall Street faces a pivotal stretch dominated by heavyweight earnings and the latest snapshot of U.S. employment. The combination of results from Disney, pharmaceutical majors, semiconductor leaders and two technology titans, followed by the monthly jobs report, will likely determine the market’s near-term direction.

Crédito da imagem: CNBC