- 401(k): This is typically an employer-sponsored retirement plan. If you’ve worked for a company, chances are you’ve had the option to contribute to a 401(k). Contributions are usually deducted directly from your paycheck. A big perk of 401(k)s is often the employer match – free money that can significantly boost your retirement savings. They generally have higher contribution limits than IRAs.

- IRA: Unlike a 401(k), an IRA is an individual account you set up yourself, usually through a bank or brokerage firm. You don’t need an employer to have an IRA. They are popular for self-employed individuals or those who want to supplement their employer-sponsored plans. IRAs come in different flavors, primarily Traditional and Roth.

Understanding these basic distinctions is the first step in taking control of your retirement accounts and ensuring your money works for you.

For complete details on contribution rules and limits, you can consult the official Internal Revenue Service (IRS) website. or Visit the IRA Guide on the IRS website for detailed information

📌 Traditional vs. Roth: Understanding the Tax Benefits

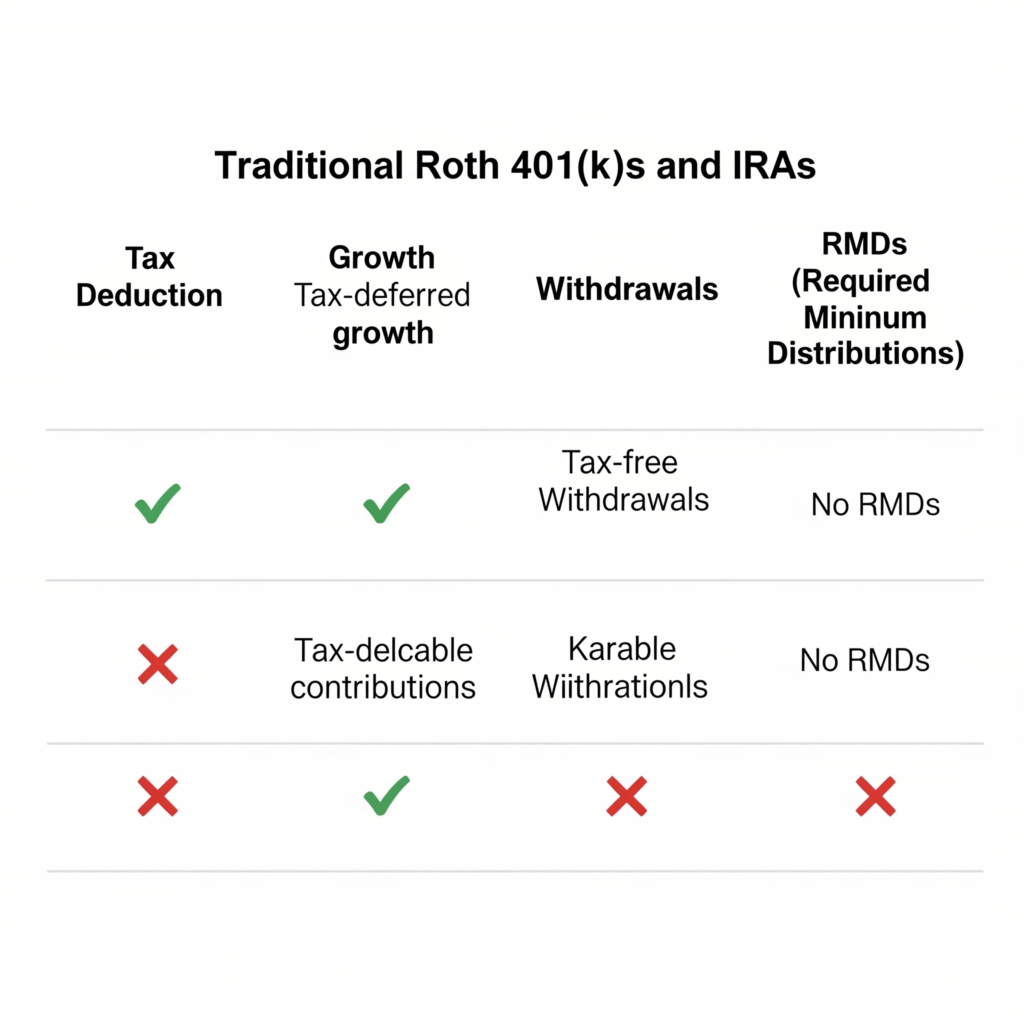

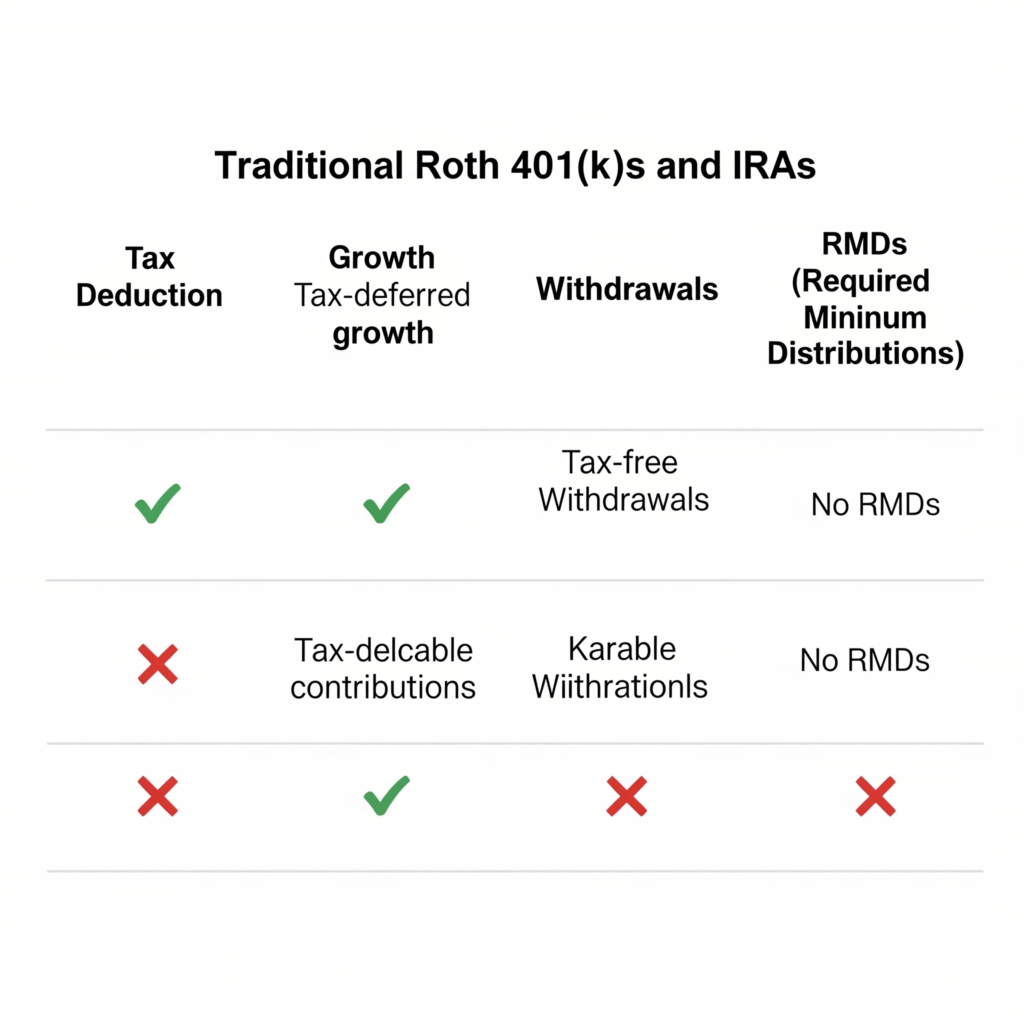

The choice between Traditional and Roth versions of retirement accounts is a common point of confusion, especially as you approach or enter retirement. The main difference lies in when you get your tax break:

The decision between Traditional and Roth can have significant long-term implications for your retirement savings and should be a key part of your financial planning for retirees. It’s often beneficial to have a mix, giving you flexibility in retirement.

📌 Navigating Rollovers and Required Minimum Distributions (RMDs)

As you transition into retirement, two terms will become particularly important: rollovers and Required Minimum Distributions (RMDs).

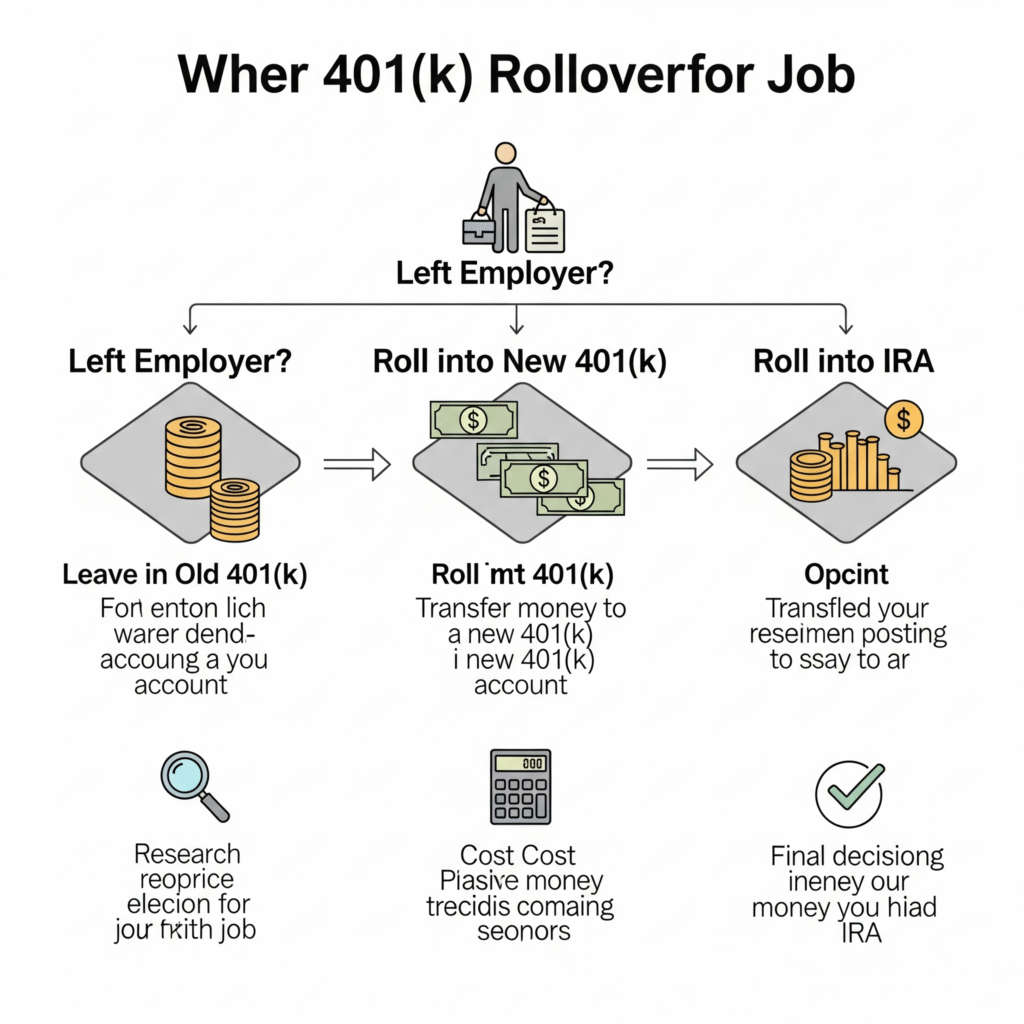

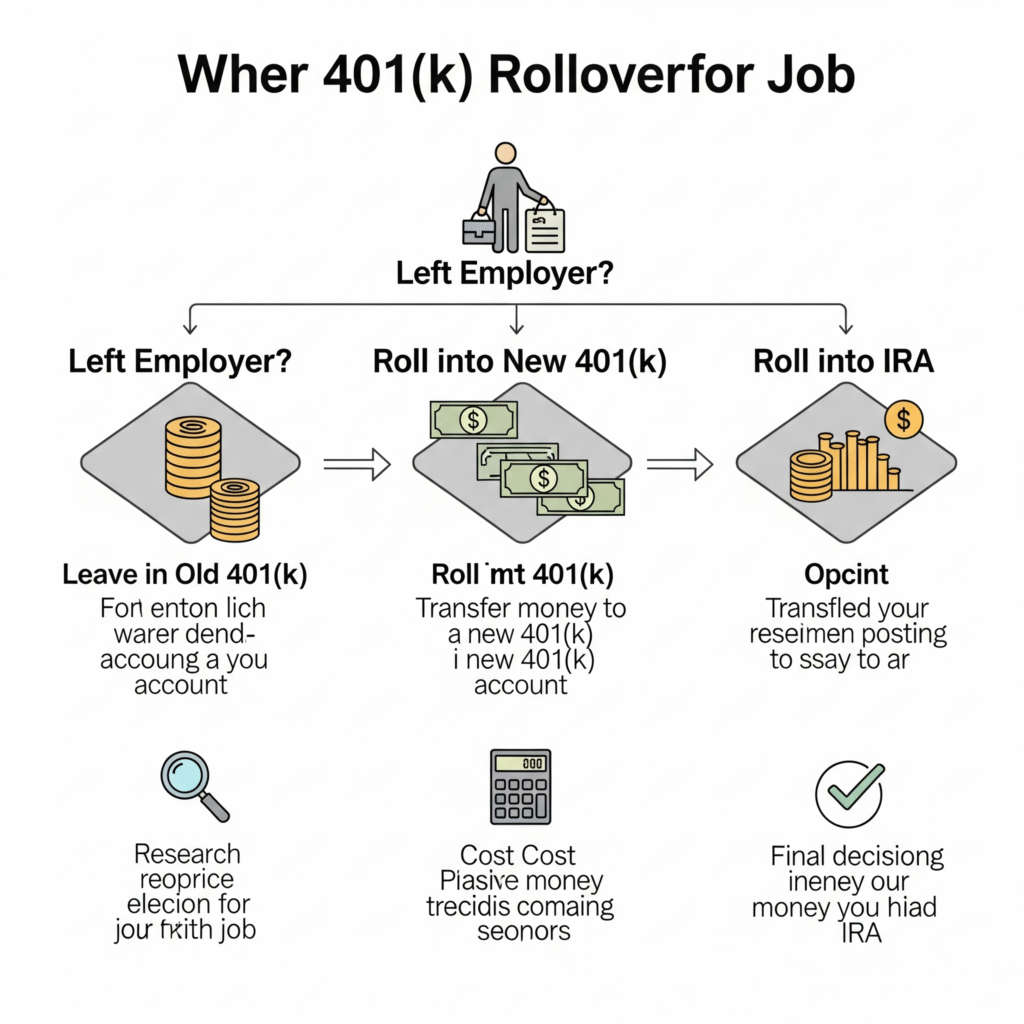

- Rollovers: When you leave an employer, you typically have options for your 401k. You can leave it with your old employer, cash it out (often a bad idea due to taxes and penalties), or roll it over into a new employer’s plan (if applicable) or into an IRA. A direct rollover to an IRA is a common and often smart move for many retirement investors. This allows you to consolidate your retirement accounts, potentially reduce fees, and gain more control over your investment choices. Be very careful with indirect rollovers, as they can lead to tax penalties if not handled correctly.

- Required Minimum Distributions (RMDs): Once you reach a certain age (currently 73 for most people), the IRS requires you to start withdrawing money from most Traditional retirement accounts (like Traditional 401(k)s and Traditional IRAs). This is called an RMD. The amount you must withdraw each year is calculated based on your account balance and life expectancy. Failing to take your RMD can result in significant penalties (25% of the amount you should have withdrawn!). Roth IRAs do not have RMDs for the original owner, which is another attractive feature for retirement investors seeking tax-free income later in life.

📌 Maximizing Your Retirement Investments: Strategies for Seniors

For seniors, managing retirement investments shifts from aggressive growth to preservation and income generation. Here are some strategies to consider:

- Asset Allocation Review: Re-evaluate your investment mix. As you get older, you generally want to shift from higher-risk, higher-growth investments (like stocks) to more stable, income-generating ones (like bonds or dividend-paying stocks). This helps protect your principal.

- Income Generation: Think about how your retirement accounts can provide a steady income stream. This might involve dividend investing, bond ladders, or even exploring annuities (though be cautious and understand their complexities).

- Withdrawal Strategy: How you withdraw money can significantly impact how long your retirement savings last. The “4% rule” is a common guideline (withdrawing 4% of your portfolio in the first year, then adjusting for inflation), but your personal situation and market conditions should always be considered.

- Catch-Up Contributions: If you’re 50 or older and still working, the IRS allows you to make “catch-up contributions” to your 401(k) and IRA beyond the standard limits. This is a fantastic way to boost your retirement savings in the years leading up to retirement.

- Consider a Roth Conversion: While complex, converting some of your Traditional IRA or 401k funds to a Roth account could be beneficial if you anticipate higher taxes in the future. This strategy involves paying taxes on the converted amount now in exchange for tax-free withdrawals later. This is a significant decision and should always be discussed with a qualified financial advisor.

📌 The Importance of Professional Guidance in Your Financial Planning

While this guide aims to simplify 401k and IRA concepts, the world of financial planning for retirees can still be intricate. Given the high stakes involved in protecting your retirement savings and ensuring they last, seeking professional guidance is often one of the best investments you can make.

A qualified financial advisor can help you:

- Tailor a Strategy: Develop a personalized plan that aligns with your specific goals, risk tolerance, and time horizon.

- Navigate Tax Laws: Understand complex tax implications of withdrawals, rollovers, and estate planning, ensuring you don’t pay more than you have to.

- Optimize Investments: Choose the right mix of retirement investments to balance growth and preservation.

- Plan for Healthcare Costs: Integrate potential healthcare expenses, including Medicare, into your overall financial picture.

- Avoid Pitfalls: Identify potential risks and help you sidestep common mistakes retirement investors sometimes make.

Choosing the right advisor is crucial, so always do your homework, check credentials, and ensure they act as a fiduciary, meaning they are legally obligated to act in your best interest.

When choosing an advisor, it is vital to verify their credentials through resources such as the U.S. Securities and Exchange Commission’s (SEC) Investor.gov.

✅ Your Retirement, Decoded

Entender seu 401k e IRA não significa dominar teorias financeiras complexas, mas sim adquirir clareza e confiança em suas economias para a aposentadoria . Ao compreender os princípios básicos dessas poderosas contas de aposentadoria , entender suas implicações fiscais e gerenciar proativamente seus investimentos para a aposentadoria , você pode construir um futuro financeiro mais seguro e previsível. Lembre-se: nunca é tarde para refinar seu planejamento financeiro para aposentados . Fortaleça-se com conhecimento, busque orientação quando necessário e assuma o controle de seus anos dourados. Sua dedicação hoje renderá dividendos amanhã, garantindo que sua aposentadoria seja verdadeiramente dourada.

👉 Perguntas Frequentes (FAQ)

P1: Qual é a principal diferença entre um 401(k) e um IRA? R1: Um 401(k) normalmente é patrocinado pelo empregador, o que significa que sua empresa o oferece, e as contribuições geralmente são equiparadas. Um IRA é uma conta individual que você abre, independentemente de um empregador. Ambos são projetados para poupança para a aposentadoria .

P2: Devo manter meu antigo 401(k) com um antigo empregador ou transferi-lo? R2: Transferir seu antigo 401(k) para um IRA ou para o plano do seu novo empregador costuma ser recomendado. Isso pode simplificar suas contas de aposentadoria , oferecer mais opções de investimento e facilitar a gestão dos seus investimentos para a aposentadoria .

P3: O que acontece se eu não sacar meus RMDs? R3: Se você não sacar suas Distribuições Mínimas Obrigatórias (RMDs) do seu 401k tradicional ou IRA quando necessário, a Receita Federal (IRS) poderá impor uma multa significativa, normalmente 25% do valor que você não sacou.

P4: Posso contribuir para um IRA se já estiver aposentado? R4: Sim, você pode contribuir para um IRA tradicional em qualquer idade, desde que você (ou seu cônjuge) tenha renda. Para um IRA Roth, também há limites de renda, mas não há limite de idade se você tiver renda.

P5: O que são “contribuições de recuperação”? R5: “Contribuições de recuperação” são valores adicionais que o IRS permite que indivíduos com 50 anos ou mais contribuam para seus planos 401k e IRA além dos limites anuais padrão. Essa é uma ótima maneira de aumentar a poupança para a aposentadoria mais perto da aposentadoria.

P6: É melhor ter uma conta de aposentadoria tradicional ou Roth? R6: Não existe uma única opção “melhor”; depende da sua faixa de imposto de renda atual e futura prevista. Contas tradicionais oferecem deduções fiscais antecipadas, enquanto contas Roth oferecem saques isentos de impostos na aposentadoria. Muitos investidores de aposentadoria optam por uma combinação de opções para maior flexibilidade.

Leia também: Planejamento financeiro para idosos: como começar com metas inteligentes de longo prazo 👇

Se você trabalhou para uma empresa, é provável que tenha a opção de contribuir com um 401 (k).