Nearly 70% of participants say prices are higher today than a year ago, and 61% believe those prices are rising faster than their earnings. The squeeze is most acute for households earning $50,000 or less: 74% in the $30,000–$50,000 bracket and 78% of those below $30,000 report that wages are not keeping pace with costs.

Average holiday budget remains flat

On average, Americans expect to lay out $1,016 on holiday gifts, effectively unchanged from last season. When isolating the responses of consumers who actually plan to buy presents, projected spending climbs to $1,199, a year-over-year increase of about 3.9%.

Economic sentiment turns more negative

The survey captures a notable deterioration in overall economic outlook. Six in ten respondents describe themselves as pessimistic about present conditions as well as the year ahead—the highest combined level since December 2023. While Democratic and independent voters have voiced pessimism for much of the past several years, the latest results show a meaningful shift among Republicans: 53% now rate the economy as “fair” or “poor,” compared with a majority who called it “excellent” or “good” in prior polls.

Shopping channels continue to evolve

Concerns over pricing have influenced where people intend to shop. The poll registers:

Imagem: Internet

- a 9-point increase in consumers who expect to make most purchases online,

- a 3-point rise in those favoring big-box retailers such as Walmart or Best Buy, and

- a 6-point gain for wholesale outlets that include membership clubs.

Households planning to spend more than $1,000 are gravitating toward warehouse clubs, while shoppers budgeting between $500 and $1,000 display a stronger preference for e-commerce. The move to online platforms is most pronounced among women, lower-income households and buyers with the smallest planned budgets.

Discount hunting intensifies

Price sensitivity is evident in purchase strategies. According to the findings, 28% of adults say they will buy only discounted items this season. Another half report they will actively look for bargains but will still complete their intended purchases even if discounts are unavailable. Just 10% indicate they are indifferent to sale pricing.

Debt levels add to financial pressure

Rising debt balances compound the burden of higher prices. Fifty-seven percent of respondents report entering the holiday period with at least some outstanding debt, up 11 points from 2024. The share describing their debt as “a lot” also climbed by five points. The biggest single-year increase is among 18- to 34-year-olds, a change that could reflect the resumption of student loan payments.

Broader economic data support the survey’s portrait of sustained price pressures. The latest Consumer Price Index release from the U.S. Bureau of Labor Statistics shows headline inflation running above the Federal Reserve’s 2% goal, reinforcing the headwinds consumers identify at the checkout counter.

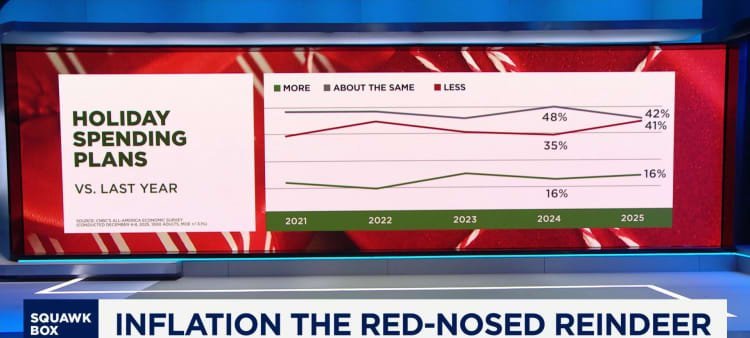

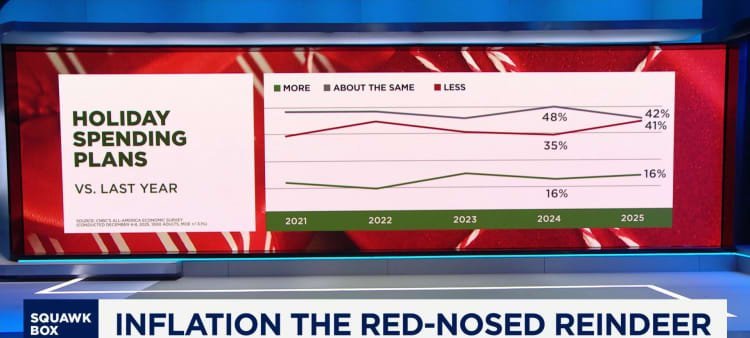

Crédito da imagem: CNBC