The annual payment notice is closely watched because it dictates how much private insurers can charge Medicare beneficiaries for monthly premiums and plan benefits. An increase of less than one-tenth of a percent could limit the ability of companies to sweeten benefit packages or subsidize premiums, factors that strongly influence enrollment and, ultimately, profitability.

Medicare Advantage, the privately administered alternative to traditional Medicare, has grown steadily for years. According to health policy research firm KFF, more than half of all Medicare beneficiaries now choose these plans, attracted by lower monthly premiums and supplemental offerings such as dental or vision coverage. The robust enrollment trend has made the government payment formula a central determinant of revenue growth for insurers focused on the senior market.

CMS said the proposal also targets what it described as a profitable billing practice within the industry. By “strengthening payment accuracy and modernizing risk adjustment,” the agency aims to ensure plans are reimbursed appropriately for enrollees’ health conditions while protecting taxpayers from spending that, in the agency’s view, is not aligned with actual medical needs. In the release, CMS Administrator Dr. Mehmet Oz stated that the suggested policies are intended to keep plan choices affordable and benefits reliable for beneficiaries.

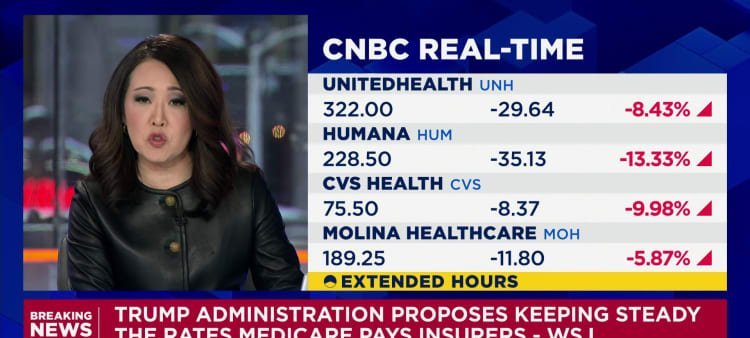

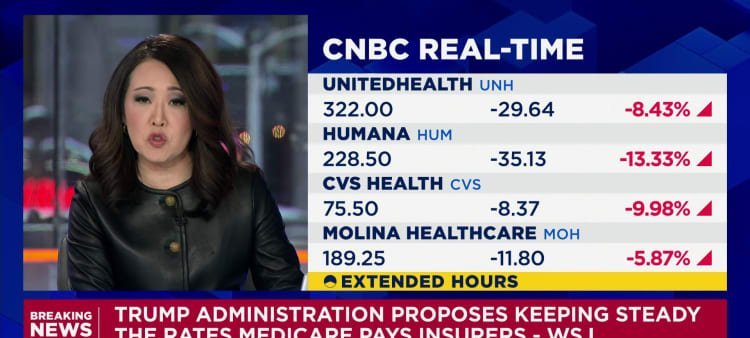

The government’s move comes after analysts anticipated another year of solid reimbursement growth following a 2026 rate hike that supported insurer earnings. Instead, the minuscule adjustment outlined Monday surprised investors and triggered the sector-wide sell-off. Although final numbers can change between the draft and April, the gap between expectations and the preliminary figure raised immediate questions about the earnings outlook for companies heavily exposed to Medicare Advantage.

Imagem: Internet

The CMS website offers a detailed summary of the methodology behind the proposed update, including technical changes to risk-adjustment calculations. Industry stakeholders typically use the public comment period to challenge or support specific elements, arguing for revisions that could yield more favorable financial outcomes.

Monday’s announcement was first reported by The Wall Street Journal and circulated quickly among investors. Trading in the impacted stocks remained active after the closing bell as market participants digested the possibility of substantially lower revenue growth next year. The broader health-care sector also moved lower, though shares of companies less reliant on Medicare Advantage experienced more modest declines.

CMS emphasized that the proposal aims to “make sure Medicare Advantage works better for the people it serves.” While the agency highlighted potential savings for taxpayers, insurers must now evaluate how a nearly flat rate environment could influence benefit design, pricing strategy and membership growth for the 2027 plan year.

Analysts noted that the final outcome will depend on stakeholder feedback and any revisions CMS adopts before April. For now, however, the preliminary notice signals that the federal government is taking a cautious approach to payment growth in a program that has seen rapid expansion and rising costs. Insurers, faced with a rate that barely outpaces zero, will likely reassess growth projections until the official numbers are released.

Crédito da imagem: CNBC