The pattern is not unique to Microsoft or Meta. Alphabet, parent company of Google, is another example of how quickly perceptions can adjust. Early last year, some analysts questioned whether Alphabet’s search dominance might erode as users experimented with OpenAI’s ChatGPT. Concerns escalated when Google’s initial public demonstrations of its Bard chatbot produced mixed reviews. Yet sentiment reversed after Alphabet released updates to its Gemini series of large language models and reported stronger demand for AI-related cloud services. As Alphabet prepares to deliver its latest results next week, Cramer suggested that investors may again reassess the firm’s competitive position in AI-enabled search.

Nvidia’s Position Viewed as More Secure

While the fortunes of Microsoft, Meta and Alphabet appear to oscillate, Cramer argued that Nvidia occupies a more stable spot within the AI ecosystem. The chip designer commands a dominant share of the data-center graphics processing unit market, and demand for its hardware remains strong as hyperscalers expand capacity. Unlike software companies whose earnings often depend on advertising budgets or enterprise subscriptions, Nvidia’s revenue growth is tied directly to the proliferation of AI workloads that require high-performance semiconductors.

“They aren’t playing a game at all. They’re running the game—they’re the house,” Cramer said, underscoring his view that Nvidia’s lead in AI chips will be difficult for rivals to dislodge in the near term.

Broader Implications for Portfolio Strategy

The recent price swings highlight a challenge for investors who want exposure to AI while maintaining portfolio stability. Quarterly earnings reports remain heavily scrutinized events, but drawing broad conclusions from one period can prove costly. Both Microsoft and Meta continue to spend aggressively on AI infrastructure, and each is working to translate those outlays into higher revenue. Azure’s growth deceleration, though a headline concern this quarter, still outpaced most competitors in percentage terms. Meta’s advertising strength, while notable, also raises the baseline for future comparisons.

Cramer’s overarching message is that the group of companies classified as hyperscalers—Microsoft, Meta, Alphabet, Amazon and others—should be viewed collectively rather than pitted against one another in zero-sum terms. Each firm is pursuing AI in distinct ways: Microsoft via cloud services and enterprise software; Meta through targeted advertising and social media engagement; Alphabet by embedding generative AI across search and productivity tools; and Amazon by integrating AI into e-commerce, logistics and its own cloud platform. Their strategies may deliver uneven quarterly outcomes, but all remain integral to the underlying infrastructure of the modern internet.

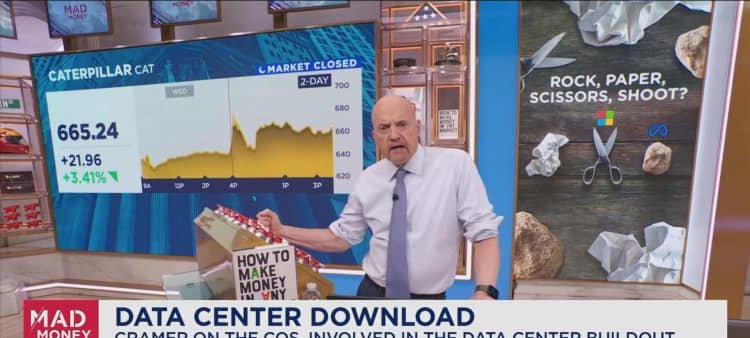

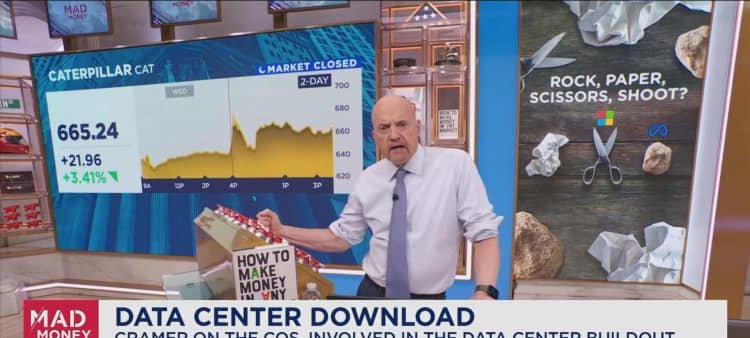

Imagem: Internet

Context Within the AI Investment Cycle

Global spending on AI systems is forecast to surpass $300 billion by 2026, according to estimates from International Data Corporation. Hyperscalers represent a significant share of that total, as they acquire advanced chips, build data centers and develop proprietary models. For equity markets, the speed at which these expenditures convert into earnings growth is a key variable influencing share prices.

Microsoft’s report suggested that capital expenditures will continue to rise, but management offered few details on how soon the spending will produce incremental revenue. Meta’s results, on the other hand, provided a clearer link between AI investments and advertising performance. Alphabet’s upcoming figures could either reinforce or challenge the view that the search leader is narrowing the gap with emerging competitors in generative AI. Meanwhile, Nvidia’s results later this quarter will be closely watched for signs that chip shortages are easing or intensifying.

Takeaway for Shareholders

For now, the lesson drawn from the latest earnings season is straightforward: reacting decisively to short-term disappointments can lead to missed opportunities if sentiment shifts just one quarter later. Large technology enterprises possess diverse revenue streams, vast user bases and the financial capacity to iterate on AI strategies. While quarterly updates provide important visibility into trends, they do not necessarily dictate the long-term trajectory of these companies.

Investors seeking disciplined exposure to AI may benefit from maintaining positions across multiple hyperscalers rather than concentrating bets on the latest perceived winner. As Cramer noted, the market’s collective opinion can pivot quickly—favoring Microsoft in one cycle, Meta in the next and Alphabet thereafter. By holding a basket of leading companies, shareholders can reduce the risk of timing errors linked to episodic swings in sentiment.

Whether Microsoft’s cloud performance rebounds, Meta’s advertising momentum endures or Alphabet’s search initiatives accelerate, the broader commitment to AI across the sector appears intact. That commitment, supported by ongoing capital investments and intense competition, continues to drive innovation and shape the future landscape of enterprise software, digital advertising and data-center infrastructure.

Crédito da imagem: CNBC