- Proprietary Products: Banks often prioritize selling their own mutual funds, annuities, insurance policies, or other financial program offerings. While these products aren’t inherently bad, they might not always be the best fit for your specific situation compared to the broader market. An independent advisor, on the other hand, typically has access to a wider range of products from various companies.

- Quotas and Incentives: Bank advisors can face pressure to meet sales quotas for certain products. This can create a conflict: are they recommending a product because it’s genuinely the best for you, or because it helps them meet a target? This is a critical question for retirement investors to consider.

- Limited Scope: A bank advisor’s expertise might be limited to the products and services offered by their institution. Comprehensive financial planning for retirees often involves looking at your entire financial picture – including taxes, estate planning, healthcare costs, and even managing financial debt – areas where a bank’s focus might be narrower.

Understanding this fundamental conflict is the first step toward advocating for your own financial well-being.

What You Might Not Be Told: Hidden Fees and Product Limitations

Beyond the sales incentives, there are other aspects of bank-based financial advice that often go unspoken:

- Hidden Fees and Commissions: While advisors may discuss obvious fees, some product fees or commissions might be less transparent. These can quietly erode your retirement savings over time. Always ask for a clear breakdown of all fees associated with any recommended product or service.

- Lack of Fiduciary Duty: Not all financial advisors are legally obligated to act in your best interest. Many operate under a “suitability standard,” meaning the product they recommend only needs to be “suitable” for you, not necessarily the absolute best option. A “fiduciary” advisor, however, is legally bound to put your interests first. It’s crucial to ask if your financial consultant operates under a fiduciary standard.

- Limited Customization: Bank-driven advice can sometimes feel like a “one-size-fits-all” approach, pushing clients into pre-packaged solutions. True financial planning for retirees requires highly personalized strategies tailored to your unique goals, risk tolerance, and income needs.

💡 To check a financial advisor’s credentials and track record, you can use FINRA’s BrokerCheck tool.

Empowering Yourself: Questions to Ask and Actions to Take

Now that you’re aware of these unspoken truths, how can you maximize your retirement and ensure your money is working for you?

- Ask About Fiduciary Duty: The most important question: “Are you a fiduciary, legally obligated to act in my best interest?” If they hesitate or say no, be cautious.

- Demand Fee Transparency: Ask for a full breakdown of all fees, commissions, and expenses associated with any investment product or service. Get it in writing.

- Question Proprietary Products: If a financial advisor exclusively recommends products from their bank, ask why. Inquire if they considered outside alternatives and how those compare.

- Seek Multiple Opinions: Don’t settle for the first advice you get. Talk to independent financial consultants or fee-only advisors who are not tied to specific products. Compare their recommendations.

- Educate Yourself: Continue learning about retirement accounts, retirement investments, and general financial planning for retirees. The more you know, the better equipped you’ll be to evaluate advice. Resources are abundant online, including educational content from the government or non-profits.

- Understand Your Risk Tolerance: Don’t let an advisor push you into investments that make you uncomfortable. Your risk tolerance should be a key driver of your retirement investments strategy.

- Review Statements Regularly: Don’t just file away your bank and investment statements. Review them carefully for unusual fees, unexplained transactions, or performance that doesn’t align with expectations. Utilize mobile banking apps to check regularly.

💡 The SEC’s Investor.gov website offers valuable resources for understanding the types of financial advisors and how they are regulated.

Looking Beyond the Bank: Alternatives for Unbiased Advice

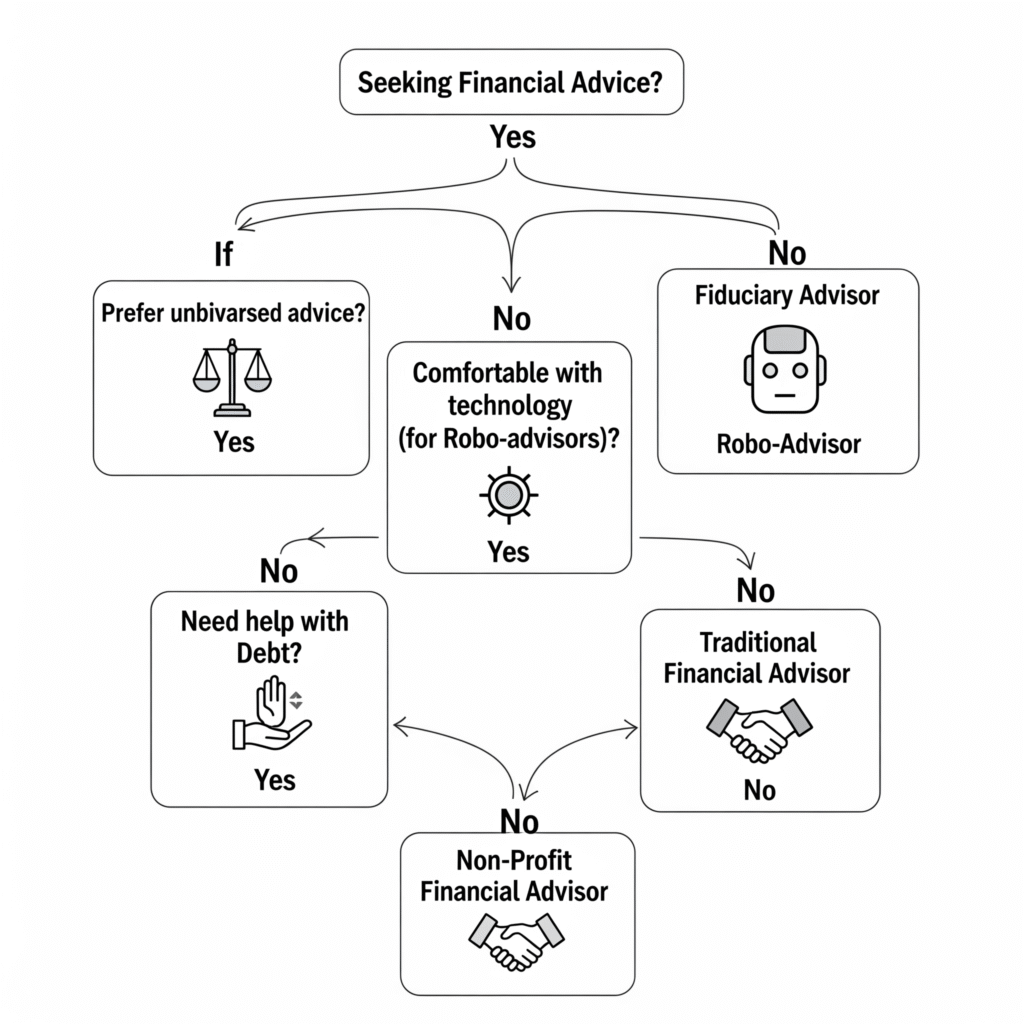

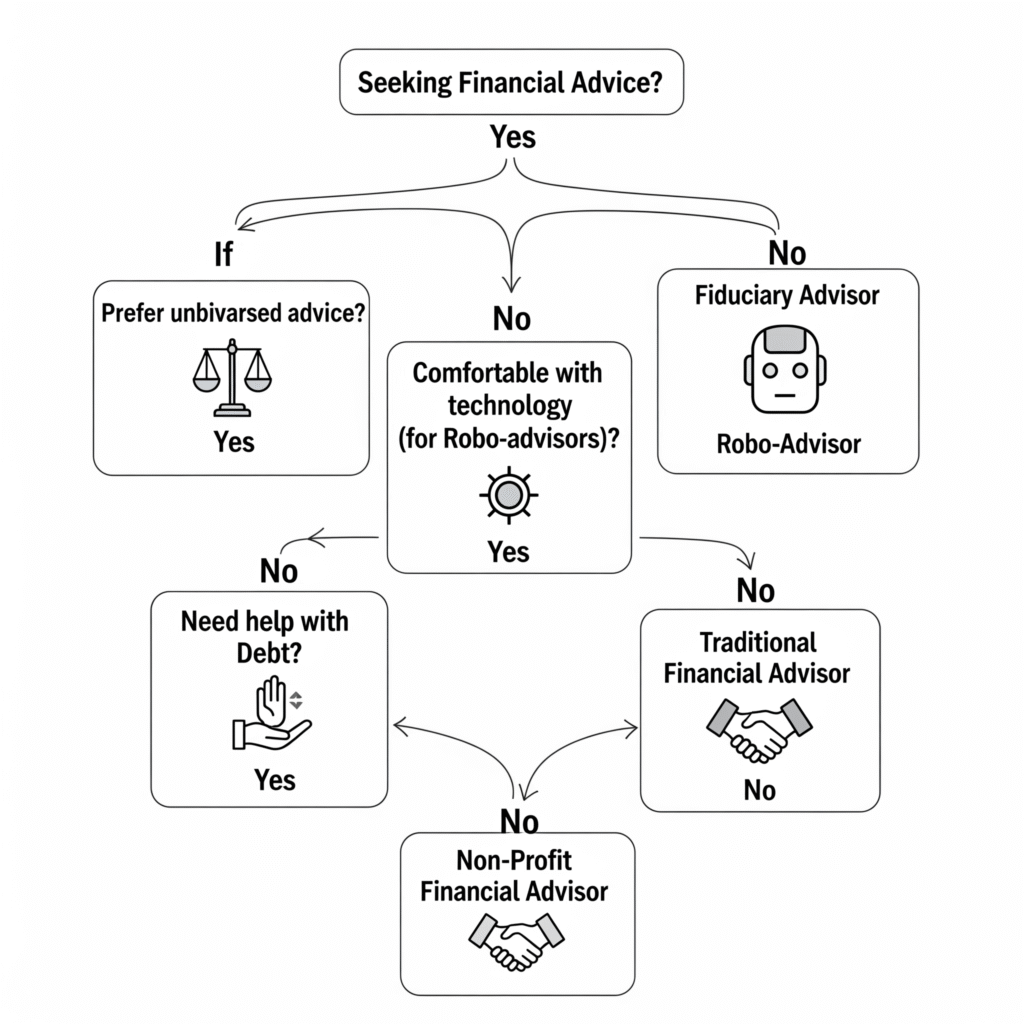

While your bank can be a great place for checking accounts and loans, it might not always be the best source for comprehensive, unbiased financial planning for retirees. Consider exploring these alternatives:

- Fee-Only Financial Advisors: These advisors charge a flat fee, an hourly rate, or a percentage of assets under management (AUM), and they do not earn commissions from selling products. This significantly reduces conflicts of interest, as their only incentive is to provide advice that benefits you.

- Robo-Advisors: For those comfortable with technology, robo-advisors offer automated retirement investments management at a very low cost. They build and manage diversified portfolios based on your goals and risk tolerance, often providing a transparent and efficient financial program for basic investing.

- Non-Profit Credit Counselors: If you’re struggling with financial debt or need help budgeting, a non-profit financial counselor can provide invaluable guidance. Their services are often free or low-cost and are focused purely on your financial health.

- Online Financial Education Resources: Reputable websites, government agencies (like the SEC or FINRA), and educational institutions offer a wealth of free information to help you understand retirement accounts and strategies.

👉 Your Retirement, Your Control

The journey to maximize your retirement requires more than just accumulating retirement savings; it demands vigilance and informed decision-making. While bank advisors can be convenient, understanding their potential biases and exploring a broader spectrum of advisory options is crucial. By asking the right questions, staying informed, and prioritizing advisors who are legally bound to your best interests, you can take true control of your retirement investments. Your financial well-being in retirement is too important to leave to chance—or to unexamined advice. Empower yourself with knowledge, and ensure your golden years are financially secure and truly maximized.

📌 Frequently Asked Questions (FAQ)

Q1: What is the main difference between a fiduciary and a suitability standard for a financial advisor? A1: A fiduciary financial advisor is legally required to act in your absolute best interest, putting your needs above their own. A “suitability” advisor only needs to recommend products that are suitable for you, not necessarily the best available.

Q2: How can I tell if my bank’s financial advisor is a fiduciary? A2: The best way is to ask them directly: “Are you a fiduciary for all the advice you provide?” You can also check their professional designations and regulatory filings with organizations like the SEC or FINRA.

Q3: Are all bank financial advisors biased? A3: Not necessarily. Many bank advisors are knowledgeable and genuinely want to help clients. However, their employment structure and compensation models can create inherent conflicts of interest that independent advisors often do not have.

Q4: What are “proprietary products” in the context of banking? A4: Proprietary products are investment or financial products (like mutual funds, annuities, or insurance policies) that are owned, managed, or directly affiliated with the bank or the larger financial institution employing the financial advisor.

Q5: How can I find an independent financial advisor? A5: You can search online for “fee-only financial advisors” or use directories from organizations like NAPFA (National Association of Personal Financial Advisors) or the Garrett Planning Network. Always check their credentials and references.

Q6: Should I avoid banks for retirement planning altogether? A6: Not necessarily avoid them entirely, but approach their financial advice with caution and a critical eye. Banks are excellent for day-to-day banking needs, but for comprehensive and unbiased financial planning for retirees, exploring independent options is highly recommended.

Read also: How to Choose a Financial Advisor for Retirement After 50 👇