Oracle Corp. shares declined roughly 5% on Wednesday after a Financial Times report indicated that talks with Blue Owl Capital to finance a planned $10 billion data-center project in Saline Township, Michigan, had stalled. The story said Blue Owl grew wary of Oracle’s mounting debt and aggressive spending on artificial-intelligence infrastructure, prompting the private-equity firm to step back from the proposed 1-gigawatt facility earmarked for use by OpenAI.

Conflicting Accounts of Financing Progress

A person familiar with Blue Owl’s deliberations said the investor examined the Michigan deal but withdrew over what the individual described as unfavorable debt terms and repayment structures. The same person added that concerns about potential construction delays tied to local political issues also weighed on the decision. Despite exiting the project, Blue Owl remains involved in two other Oracle data-center developments, one in Abilene, Texas, valued at approximately $15 billion, and another in New Mexico estimated at $18 billion.

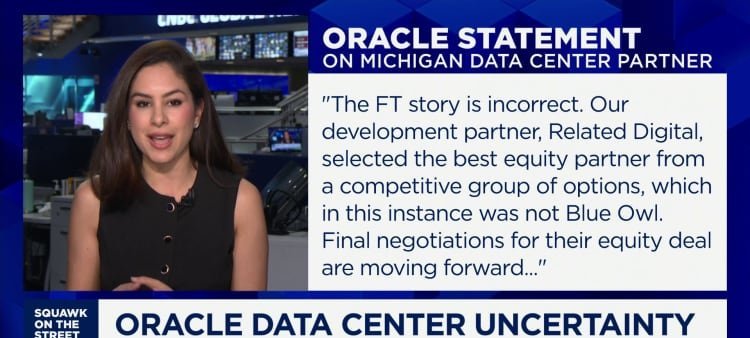

Oracle disputed the notion that momentum on the Michigan build has slowed. Company spokesperson Michael Egbert said the development partnership, led by Related Digital, selected a different equity backer through a competitive process and that negotiations “are moving forward on schedule.” Related Digital spokesperson Natalie Ravitz likewise rejected any suggestion that Blue Owl “walked away,” stating that the chosen investor possesses “unparalleled expertise” in large-scale digital infrastructure. Neither Oracle nor Related Digital identified the replacement partner, though the FT reported that Blackstone is in discussions to assume the financing role. No agreement has been executed.