The scale of those commitments has pushed Oracle deeper into the bond market. In September, the firm completed an $18 billion bond sale, one of the technology sector’s largest on record. Kehring pledged to preserve Oracle’s investment-grade credit rating, yet the cost of insuring the company’s debt has climbed as some market participants question that objective. Analysts at D.A. Davidson recently highlighted the risk that Oracle may need to modify terms of its OpenAI contract to avoid pressure on its balance sheet.

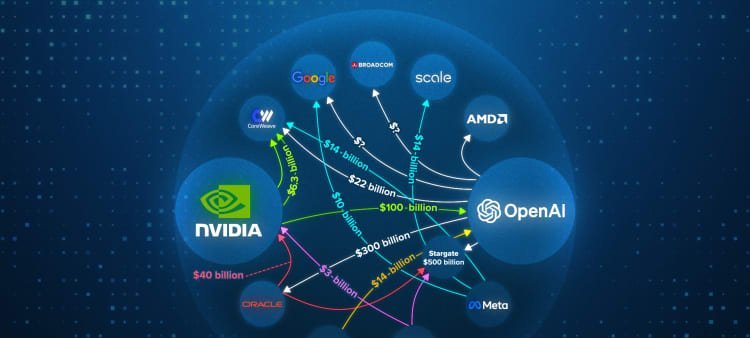

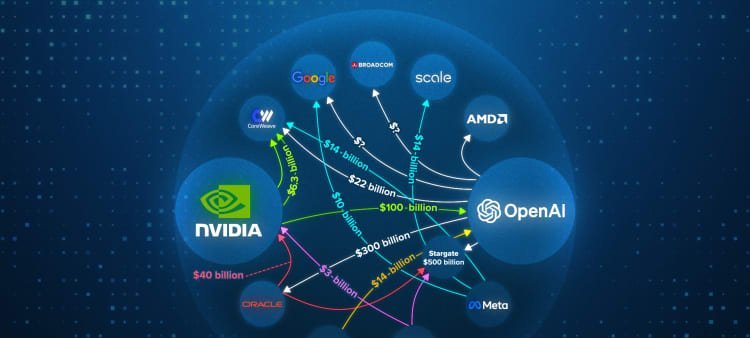

Oracle’s recent stock volatility marks a sharp reversal from the optimism that followed the OpenAI partnership. On 10 September, reports of the agreement—which calls for more than $300 billion in spending with Oracle over time—sent the shares up almost 36% in one session, the company’s third-largest single-day rally since its 1986 initial public offering. The stock set an intraday high of $345.72 before momentum faded; it closed Wednesday at $197.49. A brief uptick last week, triggered by TikTok’s plan to sell a portion of its U.S. business to Oracle and other investors, was insufficient to alter the broader trend.

Some long-time shareholders remain patient. Pennsylvania-based Lountzis Asset Management, which began accumulating Oracle stock in 2020, added roughly 30,000 shares in the first quarter. The firm’s view is that the recent pullback represents a correction after an extended run-up rather than a signal that Oracle’s fundamental prospects have deteriorated.

Oracle’s leadership maintains that large-scale cloud and AI services can dramatically expand revenue. In an October investor briefing, Magouyrk, Sicilia and Kehring projected that annual sales could reach $225 billion in fiscal 2030, up from an estimated $57 billion in fiscal 2025. Most of the expected growth is tied to AI infrastructure featuring Nvidia GPUs. However, the company acknowledged that the shift would pressure profitability: analysts surveyed by FactSet forecast Oracle’s gross margin falling from 77% in fiscal 2021 to about 49% by 2030, with cumulative negative free cash flow of roughly $34 billion over the next five years.

The strategy places heavy reliance on OpenAI, which has publicly committed to more than $1.4 trillion in AI-related investments and continues to burn cash as it scales ChatGPT and other services. Some fund managers question whether OpenAI can sustain the expenditure level implied by its Oracle contract.

Imagem: Internet

Wall Street opinion is divided. Earlier this month, Wells Fargo initiated coverage with an “overweight” designation and a $280 price target, arguing that successful execution of the OpenAI deal could make the partnership responsible for more than one-third of Oracle’s revenue by 2029. The bank’s analysts contend that convincing results from early generative-AI clusters would improve Oracle’s standing in a cloud infrastructure market led by Amazon Web Services, Microsoft Azure and Google Cloud.

Gaining share against those established providers remains challenging. Research from Gartner indicates Oracle did not rank among the top five cloud infrastructure vendors by 2024 revenue, even though its customer list includes Meta, Uber and Elon Musk’s xAI initiative. Prominent data-platform companies Databricks and Snowflake have yet to port their services to Oracle’s cloud, noting that client demand for such an option is still limited.

Oracle’s funding model further complicates its competitive push. Issuing additional debt could expose the company to rating downgrades if expected cash flows from AI workloads do not materialize on schedule. Conversely, scaling back capital expenditure might jeopardize commitments to OpenAI and other clients, slowing the revenue ramp the company has promised.

As the quarter draws to a close, the share-price downturn highlights the tension between Oracle’s ambitious growth narrative and investors’ preference for nearer-term visibility. Delivering on large-scale AI capacity, controlling leverage and demonstrating sustainable demand from OpenAI will be central tests for Magouyrk and Sicilia as they navigate their first year at the helm.

Crédito da imagem: Shelby Tauber | Reuters