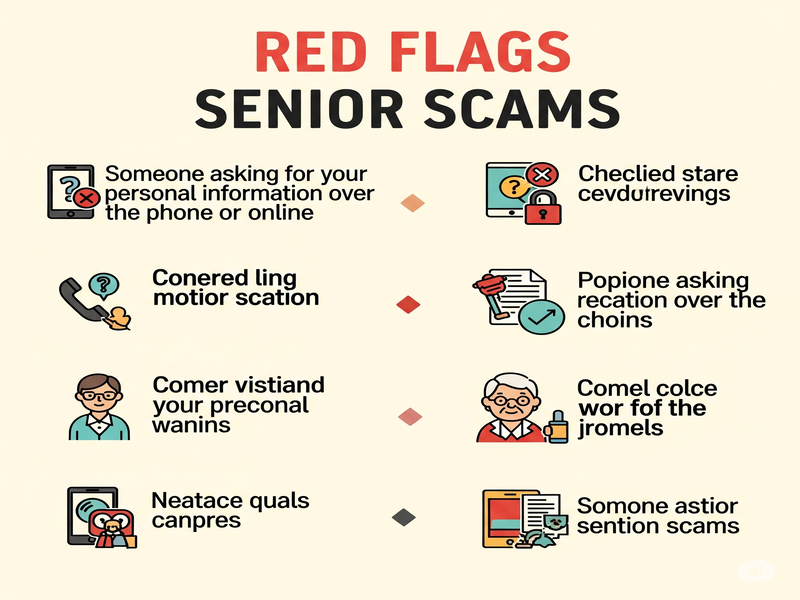

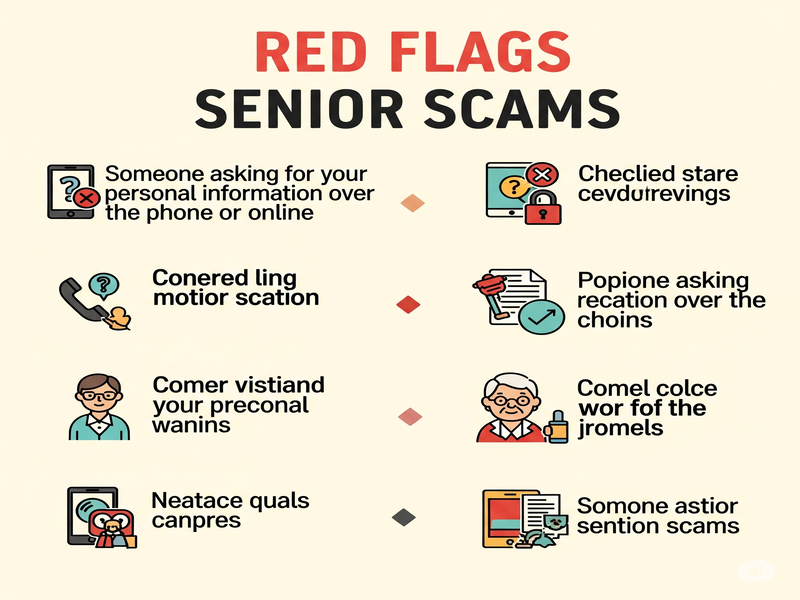

Common tactics used by scammers often involve creating a sense of urgency, isolation, or overwhelming complexity. They might impersonate trusted authorities, evoke emotional responses, or promise unrealistic returns on investment. The sophisticated nature of these operations means that it’s often hard to discern legitimate opportunities from fraudulent schemes. Recognizing these underlying vulnerabilities and manipulative approaches is the first crucial step in scam prevention for seniors. It’s about being aware, not afraid. Knowing their game helps you stay ahead.

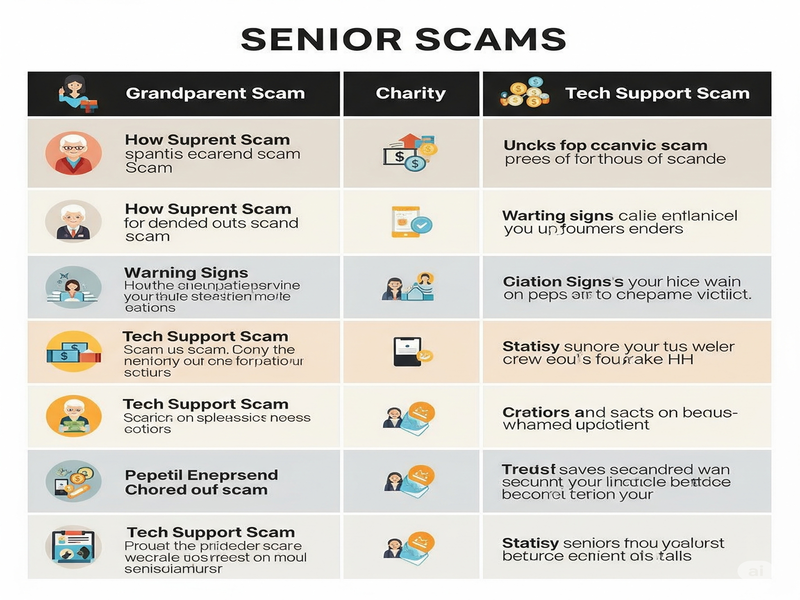

Common Senior Scams and How to Spot Them

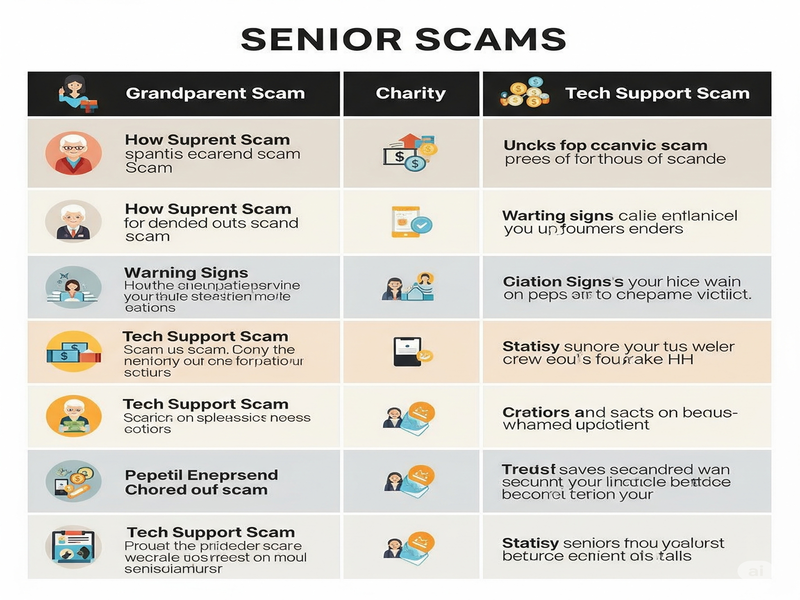

To effectively protecting senior assets, you need to be familiar with the types of scams that are rampant today. Here’s a breakdown of the most prevalent ones and their tell-tale signs:

- Government Impersonation Scams: Criminals pretend to be from the IRS, Social Security Administration (SSA), Medicare, or other government agencies. They might threaten arrest or loss of benefits if you don’t pay “taxes” or provide personal information immediately.

- Red Flag: Government agencies will never demand immediate payment via gift cards, wire transfers, or cryptocurrency. They won’t threaten arrest for unpaid taxes or Social Security issues. All official communication about benefits or taxes comes through official mail.

- Tech Support Scams: You receive a pop-up warning on your computer screen or a phone call claiming your computer has a virus or other serious issue. The “technician” then asks for remote access to your computer and/or payment for unnecessary “repairs.”

- Red Flag: Legitimate tech companies don’t send unsolicited warnings or make cold calls. If you get such a message, shut down your computer and contact your actual tech support directly using a number you know is legitimate, not one from the pop-up.

- Grandparent Scams: You get an urgent call or message from someone claiming to be your grandchild in distress (e.g., arrested, in an accident, stranded abroad) who needs money immediately and asks you not to tell their parents.

- Red Flag: Always verify. Call the grandchild directly on a number you know is theirs. Ask personal questions only your real grandchild would know. Never send money under pressure.

- Lottery or Sweepstakes Scams: You’re told you’ve won a huge sum of money but must pay “taxes” or “fees” upfront to claim your winnings.

- Red Flag: You never have to pay to receive legitimate lottery winnings. If you didn’t enter, you can’t win. This is a classic financial scam.

- Romance Scams: Scammers create fake online profiles to establish romantic relationships, often over months, then invent emergencies (medical, travel, business failures) to ask for money.

- Red Flag: Be wary of anyone who asks for money, refuses to meet in person, or declares love quickly, especially if they are overseas.

- Home Repair Scams: Someone knocks on your door offering unsolicited home repair services (e.g., roofing, driveway paving) at a “discount,” demands upfront cash, does shoddy work or no work at all, and then disappears.

- Red Flag: Always get multiple bids, check references, and ask for written contracts. Don’t feel pressured into on-the-spot decisions.

Proactive Steps to Safeguard Your Senior Savings

While identifying scams is crucial, taking proactive measures is the best defense. Here’s how to protect yourself from scammers and maintain your financial independence:

- Be Skeptical of Unsolicited Contact: If someone contacts you unexpectedly by phone, email, text, or social media asking for money or personal information, assume it’s a scam until proven otherwise. This includes calls claiming to be from your bank or a government agency if you didn’t initiate the contact.

- Verify, Verify, Verify: Before acting on any request, independently verify the identity of the person or organization. Use official phone numbers from their website or statements, not numbers provided by the caller. Call a trusted family member or friend for a second opinion.

- Protect Personal Information: Never share your Social Security number, bank account details, Medicare ID, passwords, or other sensitive information with anyone who contacts you unsolicited. Be especially careful on calls, emails, or texts.

- Secure Your Digital Life: Use strong, unique passwords for all online accounts. Enable two-factor authentication (2FA) wherever possible. Be cautious of clicking on links in suspicious emails or texts. Keep your anti-virus software updated.

- Talk to Trusted Individuals: Maintain open communication with a trusted family member, friend, or financial advisor about your financial decisions and any unusual requests you receive. A fresh perspective can often spot a scam that you might miss under pressure.

- Shred Sensitive Documents: Don’t just throw away old bills, bank statements, or credit card offers. Shred them to prevent identity theft.

- Monitor Your Accounts: Regularly check your bank and credit card statements for suspicious activity. Sign up for alerts from your financial institutions.

The Role of Technology: Friend or Foe in Financial Protection?

For many seniors, adapting to new technologies can feel like a challenge, but understanding its role is essential for senior financial security. While technology has opened new avenues for scammers, it also offers powerful tools for protection. Online banking, for instance, allows for quick and easy monitoring of accounts, enabling you to spot fraudulent transactions immediately. Secure messaging apps can help you stay connected with family, making it harder for isolation-based scams to thrive.

However, the rapid pace of technological change can also be overwhelming. Many scams on the elderly exploit unfamiliarity with digital platforms. Phishing emails and fake websites are common examples. The key is to approach new technology with caution and a willingness to learn. Seek guidance from trusted sources – a tech-savvy family member, a local library, or reputable online tutorials – to understand how to use digital tools safely. Remember, the goal isn’t to become a tech expert overnight, but to gain enough confidence to navigate the basics securely.

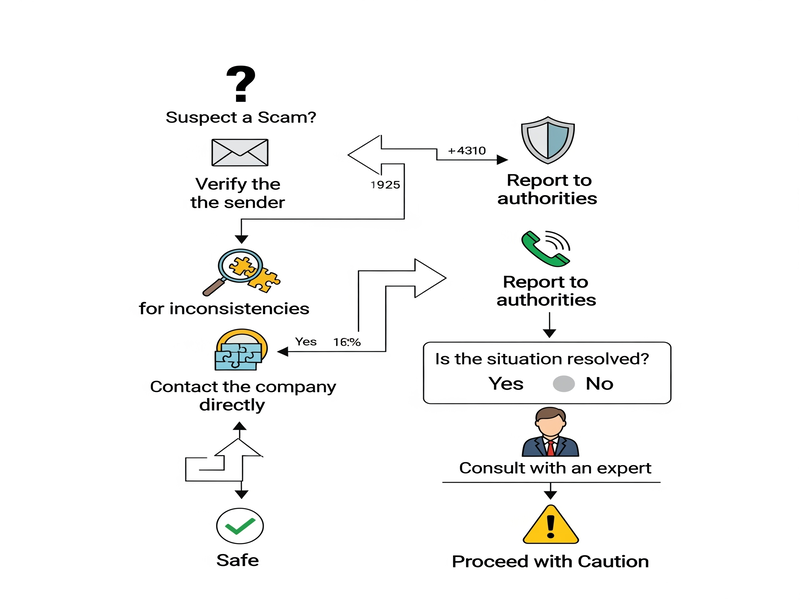

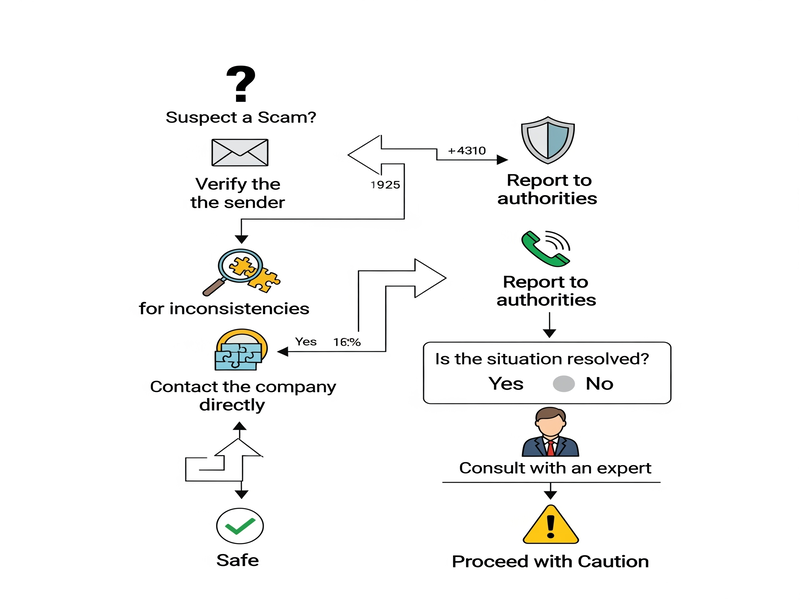

What to Do If You Suspect or Fall Victim to a Scam

Even with the best precautions, scammers are cunning, and sometimes, despite your best efforts, you might encounter or even fall victim to a scam. The most important thing is to act quickly and without shame. Reporting is crucial, not just for your recovery but to prevent others from falling victim.

- Stop All Contact: Immediately cease all communication with the suspected scammer.

- Gather Evidence: Collect any information you have: phone numbers, emails, names, addresses, transaction details, and screenshots.

- Contact Your Bank/Financial Institutions: If you sent money or shared account information, contact your bank, credit card company, or investment firm immediately. They may be able to stop transactions or freeze accounts.

- Report the Scam:

- Federal Trade Commission (FTC): File a report at reportfraud.ftc.gov. This helps law enforcement agencies track and investigate scams.

- FBI’s Internet Crime Complaint Center (IC3): If the scam involved the internet, report it to ic3.gov.

- Social Security Administration (SSA) Office of the Inspector General: If the scammer impersonated the SSA, report it at oig.ssa.gov.

- Adult Protective Services (APS): If you suspect elder abuse or exploitation, contact your local APS agency (find yours by searching online or calling your state’s elder abuse hotline).

- Local Law Enforcement: File a police report, especially if you lost money or believe a crime was committed.

Remember, you are not alone, and reporting helps authorities crack down on these criminals.

Conclusion: Empowering Your Financial Future

Navigating the complexities of finance and the ever-present threat of scams can feel daunting, but empowering yourself with knowledge is your strongest defense. This guide has aimed to expose the insidious tactics of scammers and provide you with actionable steps to protecting senior assets and retirement investment. By embracing skepticism, verifying information, securing your personal data, and knowing when and how to report, you can significantly reduce your risk. Your golden years should be spent enjoying the fruits of your labor, free from financial worry. Stay vigilant, stay informed, and most importantly, remember that protecting your money is a continuous process that you are capable of mastering.

Frequently Asked Questions (FAQ)

Q1: How do scammers usually contact seniors? A1: Scammers commonly use phone calls, emails, text messages, social media, regular mail, and even door-to-door visits. They often initiate contact unexpectedly.

Q2: What is the most common type of scam targeting seniors? A2: Government impersonation scams (IRS, SSA, Medicare) and tech support scams are among the most common, alongside grandparent scams and lottery/sweepstakes scams.

Q3: Can I get my money back if I fall victim to a scam? A3: It depends on the type of scam and how quickly you report it. Contacting your bank or financial institution immediately is crucial, as they may be able to stop transactions. However, recovery is not guaranteed, which is why prevention is key.

Q4: Should I answer calls from unknown numbers? A4: It’s generally safer not to answer calls from numbers you don’t recognize. If it’s important, they will usually leave a voicemail. Scammers often use robocalls or spoofed numbers.

Q5: What is “phishing” and how does it relate to scams? A5: Phishing is a tactic where scammers send fake emails or texts that look like they’re from legitimate companies, banks, or government agencies. Their goal is to trick you into revealing personal information or clicking on malicious links. It’s a very common method used in financial scams.

Q6: How can I help an elderly loved one avoid scams? A6: Maintain open communication, encourage them to discuss any suspicious calls or emails, help them set up strong passwords and security features online, and educate them about common scam tactics. Offer support without making them feel infantilized.

Read more : 10 Financial Mistakes to Avoid for a Secure Future

Lembre -se de que o objetivo não é se tornar um especialista em tecnologia da noite para o dia, mas obter confiança suficiente para navegar no básico com segurança.