How Does the COLA Affect Your Monthly Benefits?

The COLA increase translates into higher monthly payments for Social Security beneficiaries. For example, if your current monthly benefit is $1,800, a 3% COLA increase would raise your payment by approximately $54 per month. While this may seem modest, it can significantly improve financial stability over time.

However, it’s important to consider the Social Security tax implications 2025 . Depending on your total income, up to 85% of your Social Security benefits may be subject to federal income tax. Understanding these tax rules can help you plan your finances more effectively.

| Benefício Atual | COLA (%) | Novo Benefício Após COLA |

|---|

| $1,500 | 3% | $1,545 |

| $1,800 | 3% | $1,854 |

| $2,200 | 3% | $2,266 |

Strategies to Maximize Your Social Security Benefits

Maximizing your Social Security benefits requires careful planning and strategic decision-making. Here are some proven strategies to help you make the most of your payments:

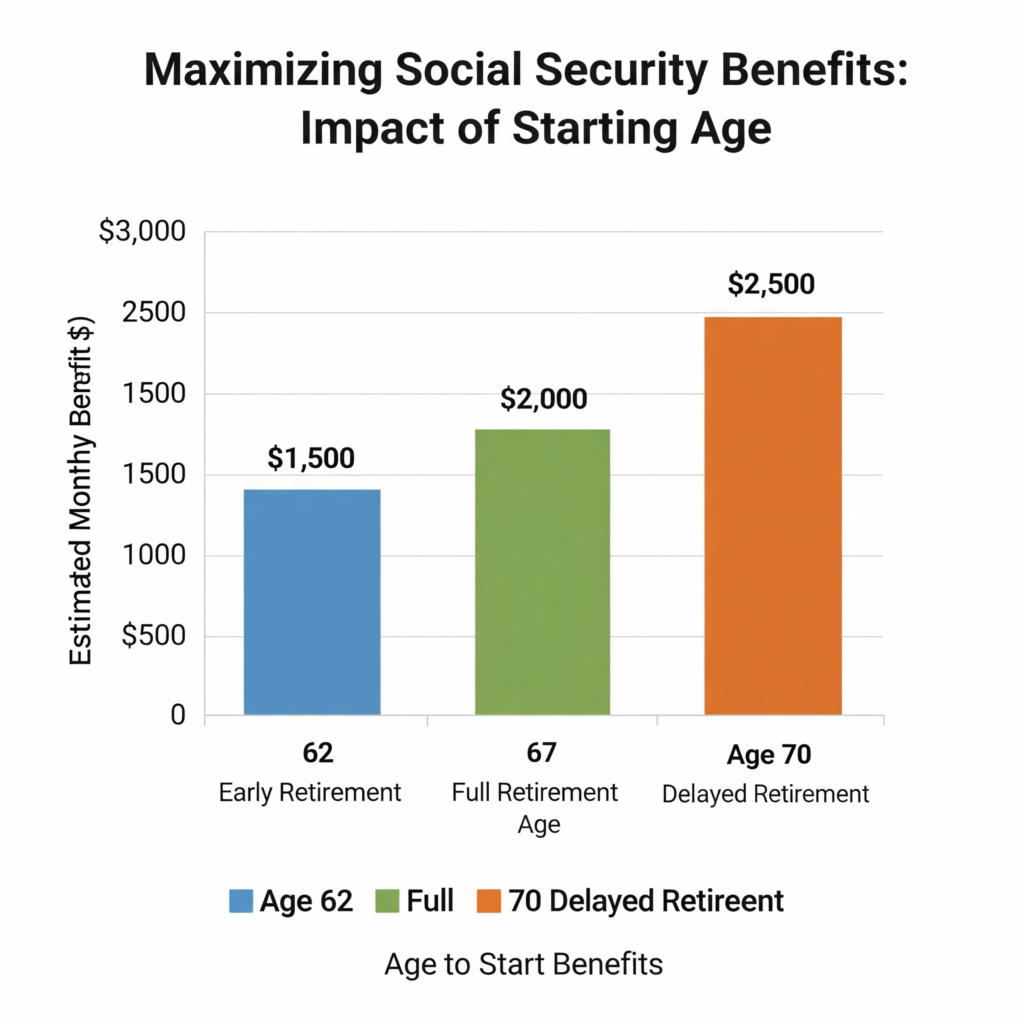

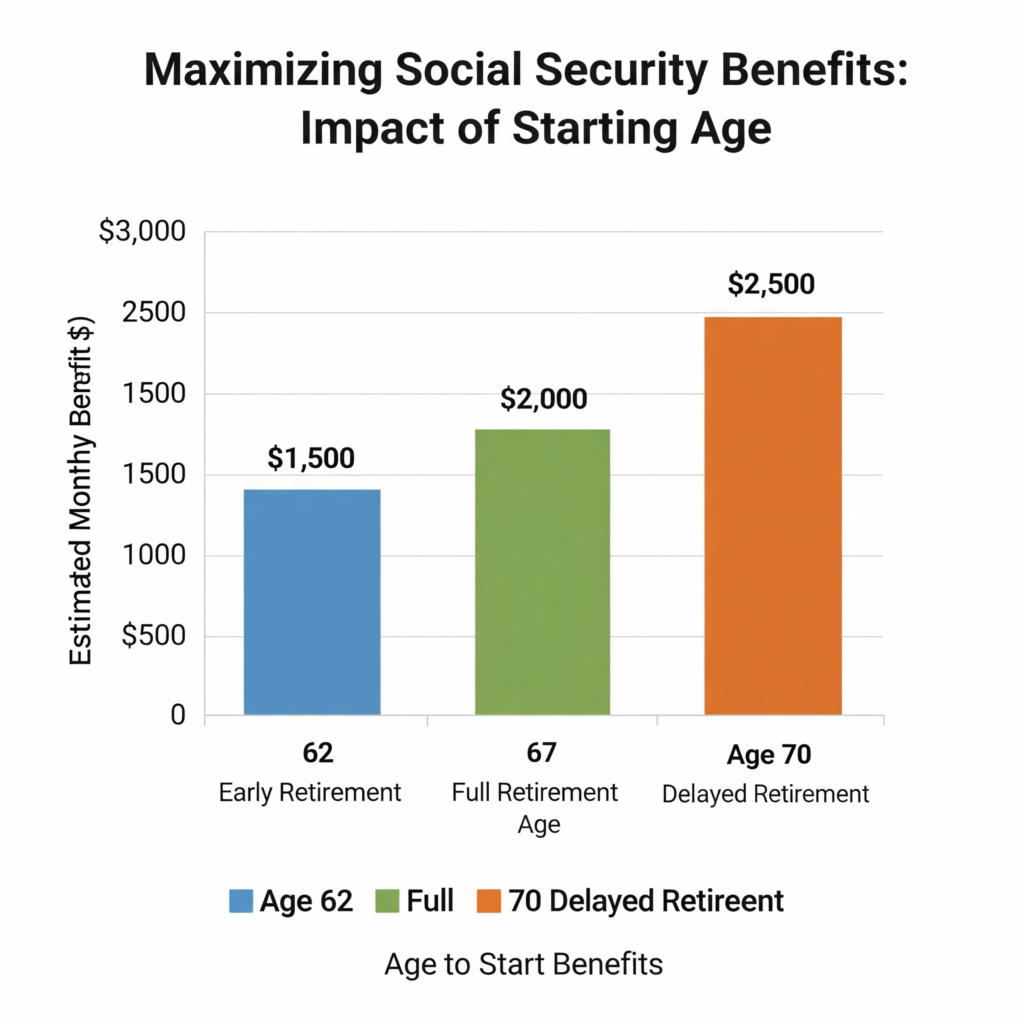

1. Delay Claiming Benefits

You can start claiming Social Security benefits as early as age 62, but delaying your claim until age 70 increases your monthly payments significantly. This strategy is ideal for seniors who can rely on other income sources during their early retirement years.

2. Combine Spousal Benefits

If you’re married, you may be eligible for spousal benefits, which allow you to claim up to 50% of your spouse’s benefit amount. Coordinating your claims with your spouse can maximize your household income.

3. Minimize Taxable Income

By managing your taxable income through strategies like Roth IRA conversions or timing withdrawals from retirement accounts, you can reduce the portion of your Social Security benefits subject to taxes.

Supplemental Security Income (SSI) and the COLA

The Supplemental Security Income (SSI) program provides financial assistance to low-income seniors and individuals with disabilities. Like Social Security benefits, SSI payments are also adjusted annually based on the COLA.

For 2025, the COLA increase will boost SSI payments, helping recipients cover essential expenses. However, it’s crucial to understand the Supplemental Security Income tax rules. While SSI payments are generally not taxable, any additional income you earn may impact your eligibility or benefit amount.

When Should You Start Claiming Social Security Benefits?

Deciding when to start claiming Social Security benefits is one of the most important financial decisions you’ll make. Here’s a breakdown of the options:

- Early Retirement (Age 62):

Claiming benefits early reduces your monthly payments permanently. This option is best for those who need immediate income and don’t expect to live long enough to benefit from delayed payments. - Full Retirement Age (66–67):

Claiming benefits at your full retirement age ensures you receive 100% of your entitled benefit amount. - Delayed Retirement (Up to Age 70):

Delaying your claim increases your monthly payments by up to 8% per year. This strategy is ideal for seniors in good health who expect to live into their late 70s or beyond.

To help you decide when to start claiming benefits, the bar chart below compares monthly payments based on the age you begin receiving Social Security.

💡 Delaying your benefits until age 70 can significantly boost your monthly income, but it’s essential to weigh this against your current financial needs and life expectancy.

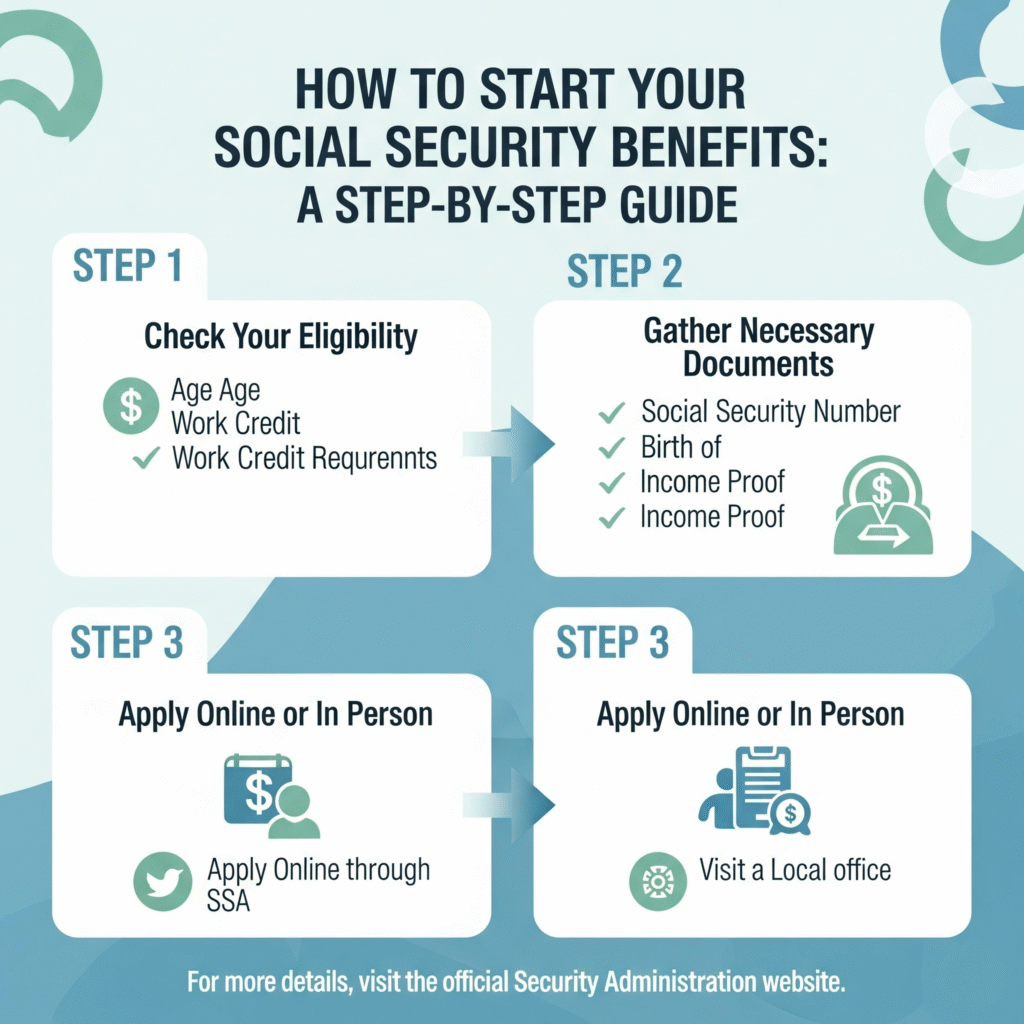

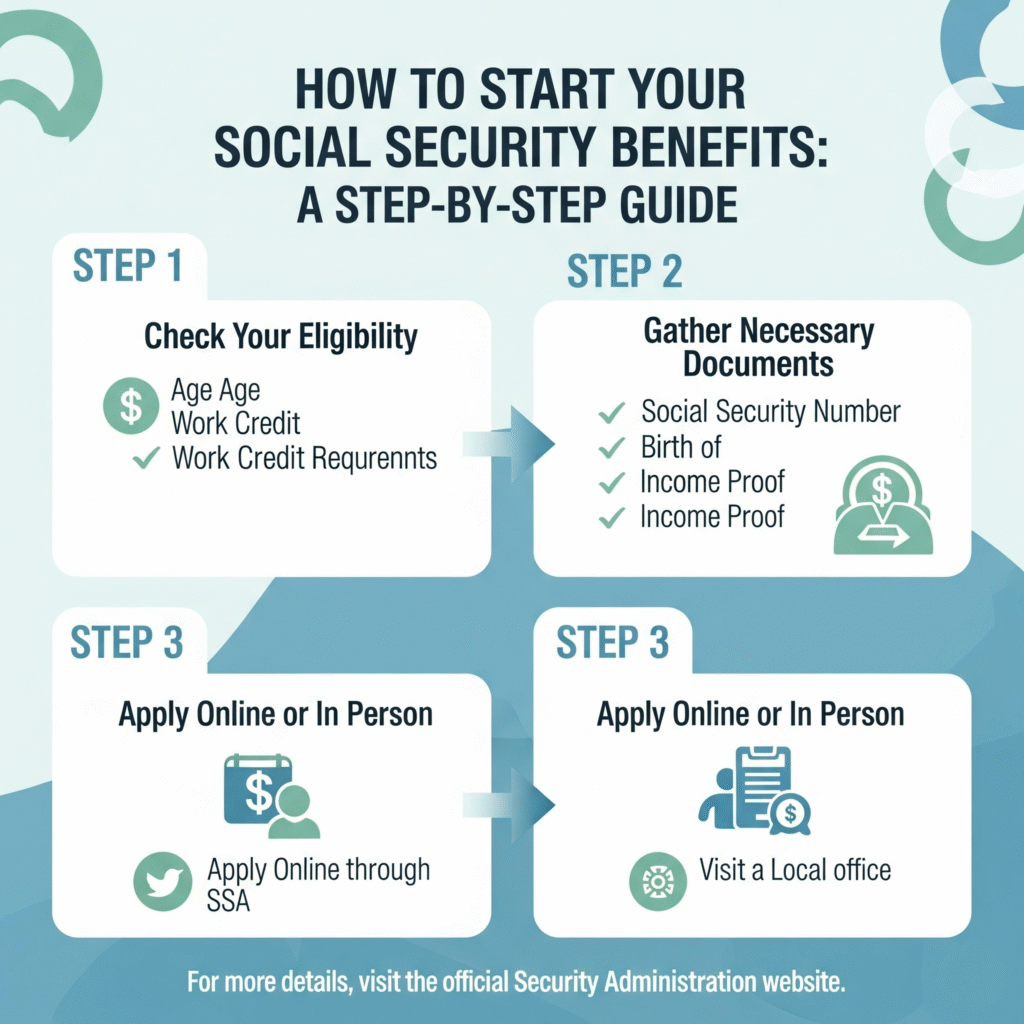

How to Start Social Security Benefits

Starting your Social Security benefits is a straightforward process, but it’s important to prepare ahead of time. Follow these steps to apply:

- Check Your Eligibility:

Ensure you meet the age and work credit requirements for Social Security benefits. - Gather Necessary Documents:

Collect documents such as your Social Security number, birth certificate, and proof of income. - Apply Online or In-Person:

Visit the official Social Security Administration website or schedule an appointment at your local office to complete the application.

Soliciting Social Security benefits is a straightforward process. Follow the steps outlined in the infographic below to ensure a smooth application experience.

💡 Pro Tip:

If you’re unsure about the process, consult a financial advisor or use resources like the Social Security Benefits 2025 guide to clarify your options.

👉 The Social Security COLA increase for 2025 is a valuable adjustment that helps seniors and retirees manage rising living costs. By understanding how the COLA impacts your monthly benefits, maximizing your payments, and planning for tax implications, you can ensure financial stability throughout your retirement years.

🌟 For more tips on retirement planning, don’t miss our article