How the idea resurfaced

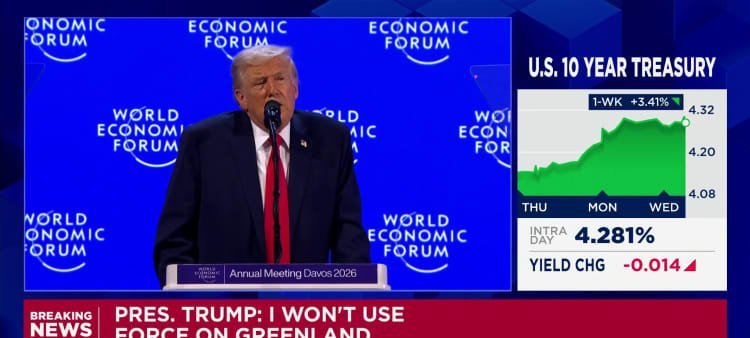

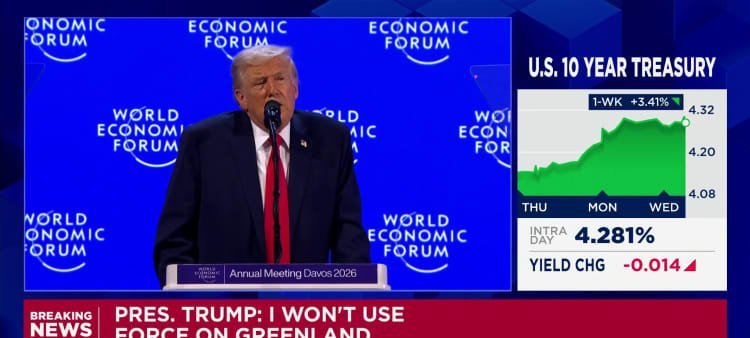

Trump’s appearance in Davos followed a 9 January post on his Truth Social platform that urged banks to “voluntarily” lower card rates to 10%. In that message he warned lenders that failure to comply would place them “in violation of the law,” a claim industry representatives immediately disputed. Behind the scenes, several large issuers signaled they had no plans to adjust pricing absent statutory changes.

During fourth-quarter earnings calls, executives at leading card lenders reiterated that caps could prompt them to close accounts—especially for borrowers with weaker credit—rather than extend credit at rates that do not cover risk and operating costs. No major institution is known to have reduced rates since the social-media pronouncement, according to research by Keefe, Bruyette & Woods (KBW).

Legislative outlook

For a cap to take effect, Congress would need to approve a bill and send it to the president’s desk. A measure introduced last year by Senator Josh Hawley, Republican of Missouri, and Senator Bernie Sanders, independent of Vermont, sought to limit credit card APRs to 10% for five years. The proposal stalled in committee and has not advanced.

Analyst Sanjay Sakhrani of KBW said bipartisan resistance makes passage improbable. Senior Republicans, including House Speaker Mike Johnson, have expressed concern that price controls on credit would distort markets and harm sectors tied to card spending, such as airlines and retailers. “If this is the path, the odds of implementation are low,” Sakhrani said in an interview.

Whether Trump’s stature within the GOP alters the calculus is uncertain. The former president maintains significant influence among conservative lawmakers, but many remain wary of dictating commercial pricing.

Industry counterarguments

Banking officials contend that a rigid cap would eliminate the ability to price loans according to borrower risk, leading issuers to withdraw credit from millions of households. Federal Reserve data show that revolving consumer credit in the United States exceeds $1.1 trillion, much of it carried on cards.

Imagem: Internet

Jamie Dimon, chief executive of JPMorgan Chase, addressed the topic at a separate Davos panel. He suggested piloting the cap in Vermont and Massachusetts—the home states of Sanders and Democratic Senator Elizabeth Warren, both longtime advocates of rate limits—to gauge economic effects. “It would be an economic disaster,” Dimon said, predicting an 80% contraction in credit card availability if the ceiling were adopted nationwide.

Political context

Trump’s request forms part of a broader affordability agenda he has championed as he seeks another term in the White House. By targeting credit card rates, the former president aims to address a pain point for consumers facing balances that accrue interest at more than 20% on average, according to industry surveys.

At the same time, the initiative illustrates the limits of presidential persuasion. Without statutory support, any voluntary move by federally regulated banks could raise questions about fiduciary duty and competitive parity. Lenders also point to state usury laws and federal pre-emption rules that already govern rate structures.

Next steps

No timetable has been set for introducing new legislation. Lawmakers must reconcile divergent views within both chambers, and committee chairs would decide whether to hold hearings. If a bill emerges, it would require majorities in the House and Senate before reaching the president.

Until then, issuers are expected to maintain existing pricing models. Market participants will monitor whether Trump’s proposal gains traction as campaigning intensifies and whether additional policymakers lend support to a cap that, for now, remains a political talking point rather than an imminent regulatory change.

Crédito da imagem: World Economic Forum