The lawsuit also accuses Dimon personally of overseeing the creation of what it describes as an internal blacklist. That list, the filing asserts, identifies individuals and entities with “a history of malfeasant acts” and is shared with federally regulated institutions. By including Trump, the Trump Organization, and related entities on that list, the complaint alleges, the bank engaged in trade libel and violated an implied covenant of good faith and fair dealing. Dimon is further accused of breaching Florida’s Unfair and Deceptive Trade Practices Act, which prohibits unfair methods of competition and unconscionable acts in commerce.

Claims for Damages and Legal Theories

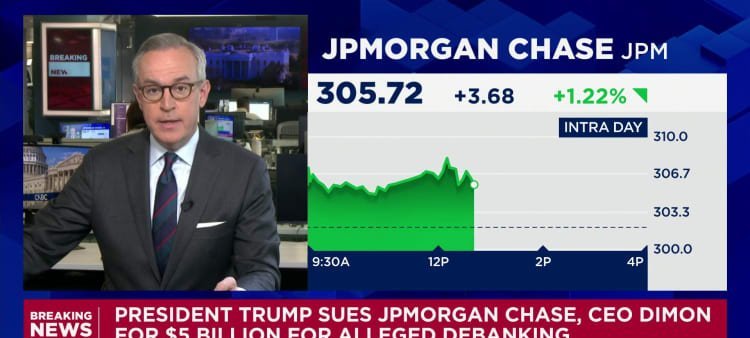

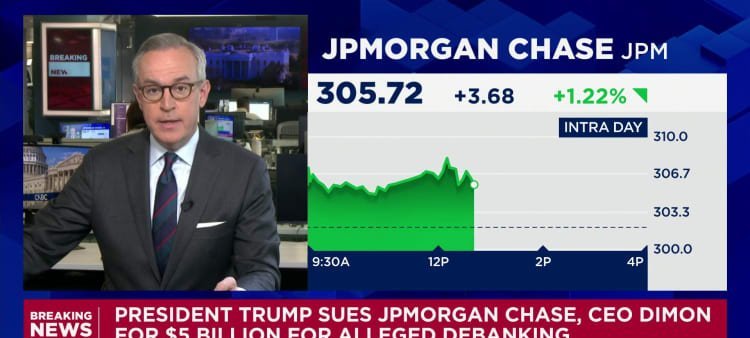

Seeking at least $5 billion in compensatory damages, the plaintiffs invoke multiple causes of action:

- Trade libel: The plaintiffs say their reputations were harmed by being categorized with parties that have engaged in illicit activity.

- Breach of implied covenant: They maintain that JPMorgan had an unspoken contractual obligation to continue providing banking services absent legitimate regulatory concerns.

- Violations of state law: Dimon is accused of deceptive practices under Florida consumer protection statutes.

The businesses involved in the complaint include Trump Payroll Corp. and an undisclosed number of limited-liability companies operating under the former president’s corporate umbrella. All assert that they were compliant with banking standards and had maintained the accounts for multiple decades prior to the closures.

Bank’s Response

In a statement released after the filing, JPMorgan Chase spokesperson Patricia Wexler said the bank believes the lawsuit “has no merit.” Wexler emphasized that JPMorgan “does not close accounts for political or religious reasons” but may do so when an account “creates legal or regulatory risk for the company.” She added that the institution has urged both current and previous administrations to modify rules that can force such decisions and expressed support for efforts “to prevent the weaponization of banking.”

The bank did not address the specific allegation that it placed Trump-related names on a blacklist circulated among other financial institutions. However, it reiterated that closures typically arise from compliance requirements or regulatory expectations, not from ideological considerations.

Imagem: Internet

Context of the Account Closures

The timing of the accounts’ termination corresponds with a period of heightened scrutiny for businesses connected to the former president. Following the Capitol breach on January 6, a number of technology platforms, professional associations, and service providers distanced themselves from Trump or organizations linked to him. The lawsuit argues that JPMorgan’s decision fit into that broader pattern and was driven by “the political tide at the moment.”

While political viewpoints are not enumerated as protected classes under federal banking regulations, guidance from agencies such as the Federal Deposit Insurance Corporation instructs banks to avoid discriminatory practices when offering or withdrawing services. The plaintiffs contend that JPMorgan violated the spirit, if not the letter, of those guidelines by targeting them for their association with conservative politics rather than any compliance lapse.

Next Steps in the Legal Process

The case will proceed in state court unless JPMorgan seeks removal to federal jurisdiction or files a motion to dismiss. If the matter advances, the plaintiffs are expected to request discovery records that could shed light on the bank’s internal deliberations. For its part, JPMorgan has indicated it will defend its account-closure policies as consistent with regulatory obligations and risk-management protocols.

Jamie Dimon, who has led JPMorgan since 2005, is named in his individual capacity for what the suit describes as “unlawful and unjustifiable” directives. The complaint does not specify any communications from Dimon that directly ordered the account terminations but asserts that decision-making ultimately rested with him.

Thursday’s filing marks one of the most significant legal challenges by Trump against a major financial institution since leaving office. The $5 billion sought represents damages for alleged reputational harm, lost business opportunities, and costs associated with finding alternative banking services. No court dates have yet been scheduled, and both sides have expressed readiness to litigate.

Crédito da imagem: CNBC