General Motors enters the spotlight on the same day. Chief Executive Mary Barra has led cost-cutting initiatives and expanded the company’s electric-vehicle strategy, yet some strategists argue the market has not fully rewarded those efforts. A pullback following earnings could present an entry point for investors who view the Detroit automaker’s transformation as undervalued.

Wednesday: The Busiest Day

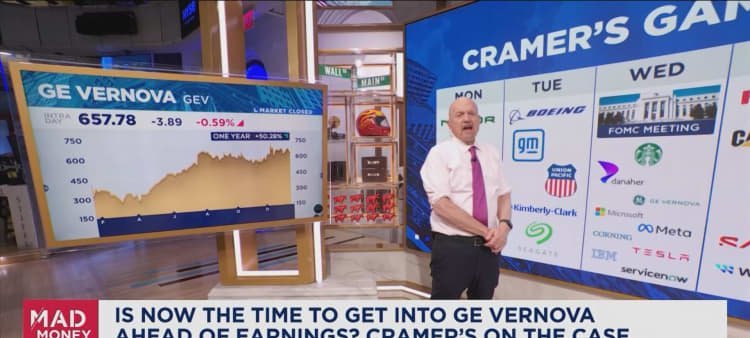

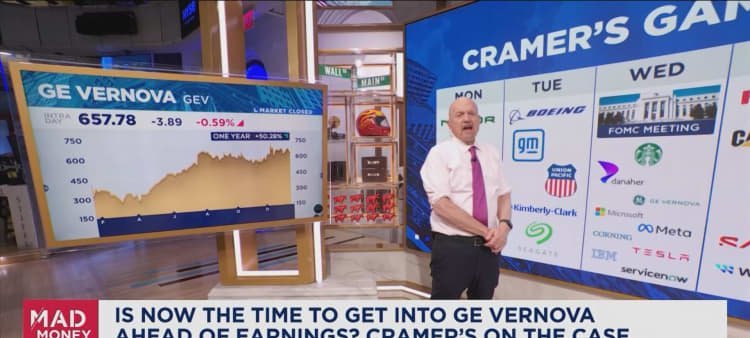

Jan. 31 features the densest roster of releases with Corning, Danaher, Starbucks, GE Vernova, Meta Platforms and Microsoft all scheduled to report before or after the closing bell.

- GE Vernova—the gas-turbine and energy unit recently separated from General Electric—nearly doubled in market value during 2025 and is up modestly in 2026. Elevated expectations could limit immediate upside even if fundamentals remain solid, according to market watchers.

- Corning benefits from increased demand for fiber-optic solutions as artificial-intelligence workloads strain existing copper networks. The market generally views the glass and materials supplier as a long-term beneficiary of data-center upgrades.

- Danaher may show its first genuinely strong quarter in years, thanks in part to a rebound in biotech capital spending. The company provides instruments and consumables essential to drug discovery and manufacturing.

- Starbucks heads into earnings after a sustained rally. Given the stock’s overbought condition, analysts caution that sustaining momentum would require numbers well ahead of consensus.

- Microsoft shares have softened with the broader software group on concerns that generative AI could disrupt existing business models. Many strategists view those fears as overstated and will parse the outlook for Azure cloud services and AI integrations.

- Meta Platforms will be evaluated on advertising trends and management commentary about returns from heavy AI investment. Chief Executive Mark Zuckerberg’s latest spending plans will receive particular attention.

Thursday: Honeywell and Apple Close the Week

Earnings momentum continues on Feb. 1 with Honeywell before the opening bell and Apple after the close. Honeywell has joined a group of industrial names that outperformed in recent months, creating a challenging backdrop if results merely meet forecasts. Investors also remain focused on the company’s plan to separate certain business lines later this year.

Apple’s stock has fallen for eight consecutive weeks, pressured by higher memory costs that could compress margins. Despite the slide, several portfolio managers maintain a long-term holding stance, citing the company’s cash generation and large installed base.

Federal Reserve Meeting

While corporate news drives day-to-day trading, the Fed’s two-day Federal Open Market Committee gathering concludes on Jan. 31. Futures pricing tracked by the CME FedWatch Tool indicates that most traders expect the central bank to leave the federal-funds rate unchanged. Attention will turn to Chair Jerome Powell’s press conference for clues on the timing and pace of potential rate reductions later in the year.

Imagem: Internet

Market participants are also alert to the possibility that President Donald Trump could signal plans for a new Fed chair the same day, a development that some analysts believe might influence asset prices more immediately than the rate decision itself.

Key Themes for Investors

The week encapsulates several broader market narratives:

- Tech vs. Industrials —Results from Apple, Microsoft and Meta will offer a benchmark for large-cap technology earnings, while Honeywell, GE Vernova and Boeing provide insight into industrial demand.

- AI Capital Expenditure —Companies such as Corning and Microsoft stand to benefit from data-center investment linked to artificial intelligence, a theme likely to recur in management commentary.

- Consumer Discretionary Signals —Starbucks and Apple will shed light on global consumer spending patterns amid mixed economic data.

- Rate Sensitivity —Nucor’s outlook and Fed communications will help assess how rate expectations influence cyclical sectors.

Market Outlook

Equity indices have started 2026 near record territory, underpinned by momentum in megacap “Magnificent Seven” stocks and a rotation into select industrial names. Volatility could rise if earnings disappoint or the Fed’s tone diverges from market assumptions. Conversely, confirmation of resilient corporate profits and a steady monetary stance may extend the current rally.

Given the volume of information arriving in a short period, portfolio managers are preparing for rapid shifts in sentiment. Many intend to use post-earnings price swings to adjust positions, particularly in companies where long-term narratives remain intact but short-term expectations appear stretched.

Crédito da imagem: CNBC